Financial services

Intelligent automation in banking and financial services

Leverage cutting-edge technologies for smarter and faster banking

Every financial services organization is faced with three critical challenges: increasing process efficiency, minimizing operational costs, and delivering exceptional customer experiences. Our mission is to help you meet these goals.

We've developed intelligent automation solutions to efficiently process your business documents and optimize your processes. Our products are powered by advanced technologies and techniques, such as artificial intelligence (AI), natural language processing (NLP), and process mining. With these capabilities, you'll boost your operational productivity, while enhancing your customer experience.

Maximize business efficiency with AI automation in banking

High processing accuracy

Advanced automation processes

Enhanced compliance standards

Frictionless onboarding

Get started immediately

eBook

Onboarding: Balance Customer Expectations with Fraud Controls in Financial Services

Digital identity proofing and identity affirmation are powerful fraud-prevention tools for secure onboarding that also increase customer confidence.

Report

7th Year in a Row: Everest Group Names ABBYY a Leader

ABBYY IDP solutions integrate and optimize multiple AI models, ensuring efficient outcomes while minimizing resource use at each stage of the document processing pipeline.

Checklist

Top 7 Document Skills for Financial Services

Find pre-built AI models for processing financial documents in the ABBYY Marketplace, ready to process your bank statements, utility bills, and IRS tax forms.

Report

7th Year in a Row: Everest Group Names ABBYY a Leader

ABBYY IDP solutions integrate and optimize multiple AI models, ensuring efficient outcomes while minimizing resource use at each stage of the document processing pipeline.

Checklist

Top 7 Document Skills for Financial Services

Find pre-built AI models for processing financial documents in the ABBYY Marketplace, ready to process your bank statements, utility bills, and IRS tax forms.

Automation in banking and financial services—use cases

Know Your Customer (KYC) compliance

Mortgage loan processing

Fraud prevention and risk management

Trade finance

Account services

Credit application processing

Document review and analysis

Customer experience

Intelligent document processing with ABBYY Vantage

Built to process any document

Document skills to help you get started

Low-code design

A platform that continuously learns

Explore ready-to-use AI extraction models

for banking and financial services

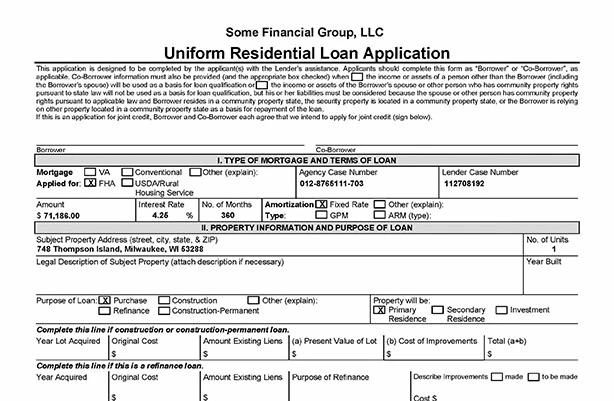

Loan Application

The ABBYY Vantage Loan Application document skill is an AI model that extracts data from Uniform Residential Loan Application Forms 1003, completed as part of mortgage loan applications.

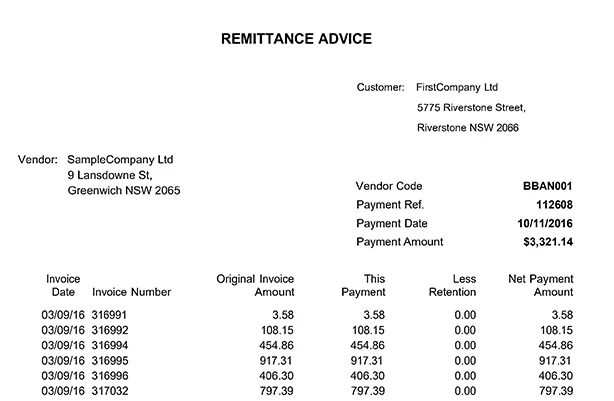

Remittance Advice

The Vantage Remittance Advice document skill is an AI model trained to extract data from remittance advice notifications from USA, Australia and New Zealand with exceptional accuracy out of the box.

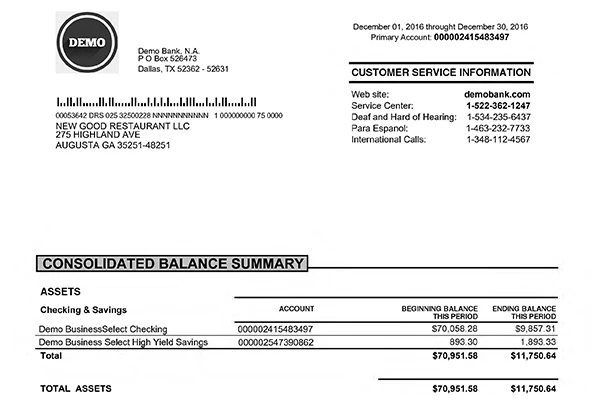

Bank Statement

The ABBYY Vantage Bank Statement document skill is a fully trained, production-ready AI model that extracts crucial data points from bank account statements issued by US American banks.

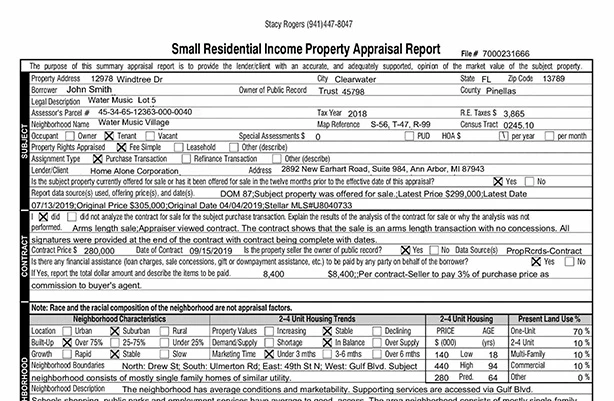

Uniform Residential Appraisal Report

The Uniform Residential Appraisal Report skill for ABBYY Vantage extracts data from US and Canadian appraisal reports (Fannie Mae Form 1004, Freddie Mac Form 70) to provide real estate and valuation details.

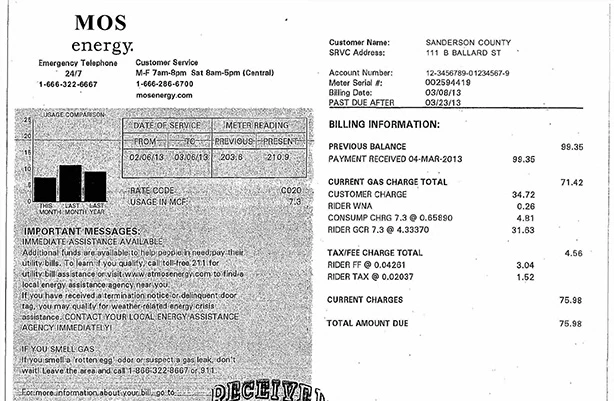

Utility Bill

The ABBYY Vantage Utility Bill skill is a ready-to-use AI model that extracts data from various utility bills, including electricity, gas, water, phone, internet, and more.

Expediting delivery of financial aid to businesses

automation of the loan request process

project deployment

processing accuracy

“In our long-term partnership with ABBYY, their intelligent technology has convinced us once more with outstanding results and helped us to develop this project in record speed during turbulent times.”

Explore automation in banking and financial services

Solution Brief

Meet ABBYY’s solution for Know Your Customer (KYC)

We illustrate how our solutions, including intelligent document processing and process intelligence, will deliver end-to-end improvements to your KYC process.

Infographic

IDC research: Empowering Financial Services to Innovate Through Automation

According to IDC, 83% of banks are increasing their automation budget in the next 12 to 24 months. Find out how AI and automation could help your organization.

Infographic

How automation is transforming financial services organizations

Our 2022 survey explores the ROI for financial services organizations implementing automation.

Solution Brief

Meet ABBYY’s solution for Know Your Customer (KYC)

We illustrate how our solutions, including intelligent document processing and process intelligence, will deliver end-to-end improvements to your KYC process.

Infographic

IDC research: Empowering Financial Services to Innovate Through Automation

According to IDC, 83% of banks are increasing their automation budget in the next 12 to 24 months. Find out how AI and automation could help your organization.

Infographic

How automation is transforming financial services organizations

Our 2022 survey explores the ROI for financial services organizations implementing automation.

Why choose ABBYY?

Trusted

Innovative

Transformative

Request a demo today!

Schedule a demo and see how ABBYY intelligent automation can transform the way you work—forever.