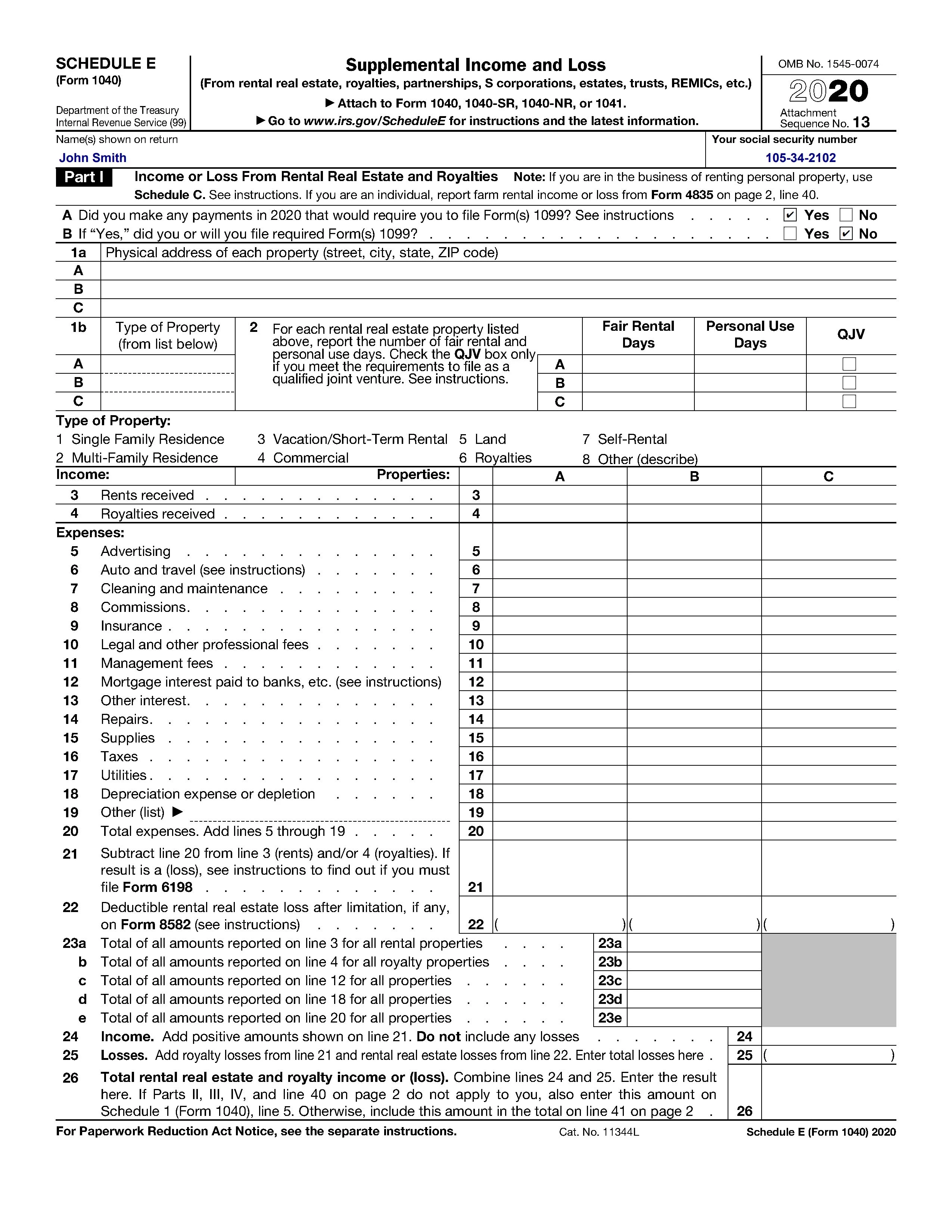

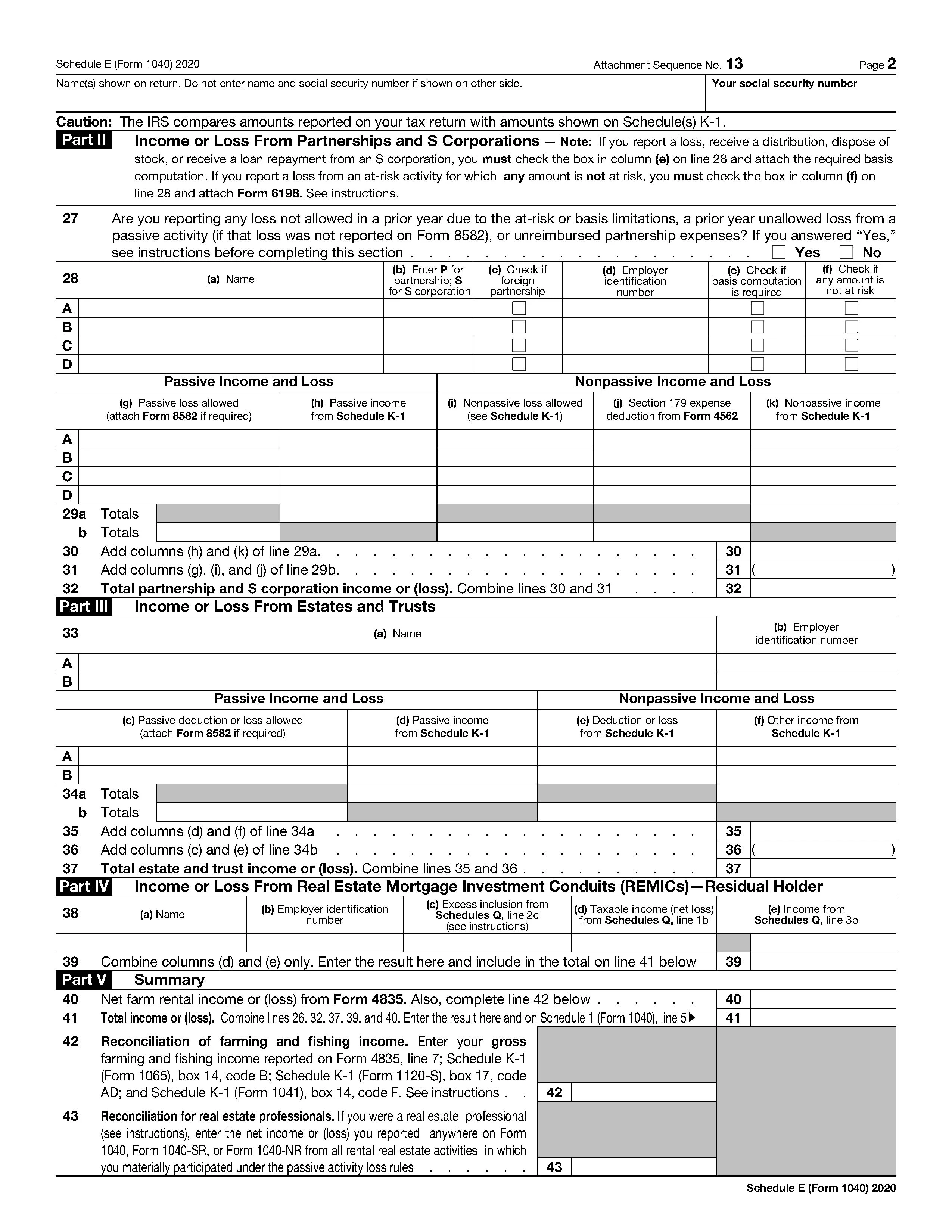

IRS Tax Form 1040 Schedule E, Supplemental Income and Loss

The Schedule E (Form 1040), Supplemental Income and Loss skill extracts data from a Schedule E supplement document to Forms 1040. A Schedule E is a document used by taxpayers in the United States to submit annual tax returns regarding incomes and losses from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in real estate mortgage investment conduits (REMIC's). The Schedule E (Form 1040), Supplemental Income and Loss documents may be submitted alongside a Form 1040 when reporting income and loss.

The Schedule E (Form 1040), Supplemental Income and Loss skill is a preview skill. It has been trained on a small document set and is intended to be used by citizen developers as a quick-start basis for processing Schedule E documents. The skill may require further training on your specific documents in order to be used in production scenarios.

Benefits

- Vantage document skills are extraction models, based on ABBYY's purpose-built AI, designed and trained to extract key data from business documents.

- Preview document skills provide a quick-start basis for conducting proof of concept and automating document-centric processes, without wasting time to train a new skill from the ground up. In most preview skills the main data fields have been labeled and the skill has been trained on a small document set to provide a starting point for further training on customer side. Preview skills generally come at no additional cost, but consume page volume from the base Vantage Core Skills volume.

- The model automatically detects key fields on Schedule E (Form 1040) documents and extracts relevant data (fiscal year, taxpayer's name, SSN etc.). For a full list of extracted fields, please see the skill documentation.

- Includes validation and data normalization rules. Further business rules can be added as required.

- Can be augmented by human-in-the-loop review and verification based on accuracy thresholds, missing or incorrect information.

- Requires further training in order to ensure sufficient accuracy levels on customer-specific documents. Training can be done up-front or during runtime as documents arrive and go through manual verification.