Automated Forms Processing

Capture data from any form automatically

Why ABBYY Form Processing Solution

Reduce processing costs

Increase business efficiency

Forms processing—customer scenarios

Accounting

- Purchase orders

- Invoices

- Accounts receivables

- Delivery dockets

Customer service

- Satisfaction surveys

- Feedback surveys

- Receipts

Human resources

- Timecards

- Payrolls

- Pledge forms

Banking and Finance

- Mortgage and loans

- Account openings

- Credit applications

- ID cards

Healthcare

- Patient records

- Registration forms

- Donation forms

- Prescriptions

Insurance

- Claim forms

- Explanations of benefits

- Accounts receivables

- Declarations

Education

- Examinations

- Tests

- School transcripts

- Students’ surveys

Government

- Tax declarations

- Census forms

- Social applications

- Voting ballots

Transportation and Logistics

- Shipping documents

- Proofs of delivery

- Custom documents

Customer story

BPO e-docs UK helps NFT Distribution to handle more than 100,000 PODs every week implementing an automated capture solution.

Customer Story

Project Orbis International improved costly processing of donation forms and saved 30% of time on data input.

Customer story

A large Malaysian bank – and Fujitsu Xerox client – reduced loan approval time by 25% and processes 1.5 million pages monthly.

Customer story

BPO e-docs UK helps NFT Distribution to handle more than 100,000 PODs every week implementing an automated capture solution.

Customer Story

Project Orbis International improved costly processing of donation forms and saved 30% of time on data input.

Customer story

A large Malaysian bank – and Fujitsu Xerox client – reduced loan approval time by 25% and processes 1.5 million pages monthly.

Why ABBYY?

Trusted

Innovative

Transformative

Explore ready-to-use AI extraction models

for automated forms processing

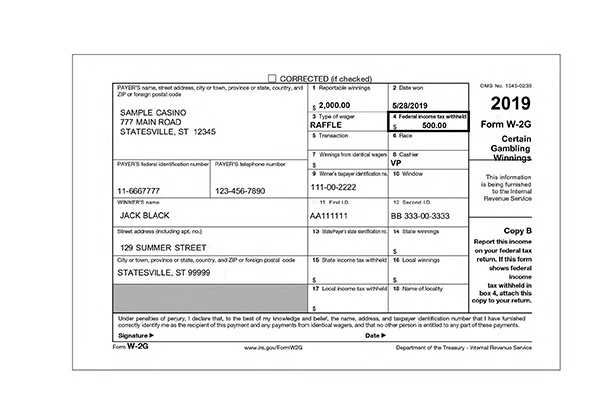

IRS Tax Form W-2G, Certain Gambling Winnings

The Form W-2G, Certain Gambling Winnings skill extracts data from Forms W-2G, which are documents used to report gambling winnings and any federal income tax withheld on those winnings.

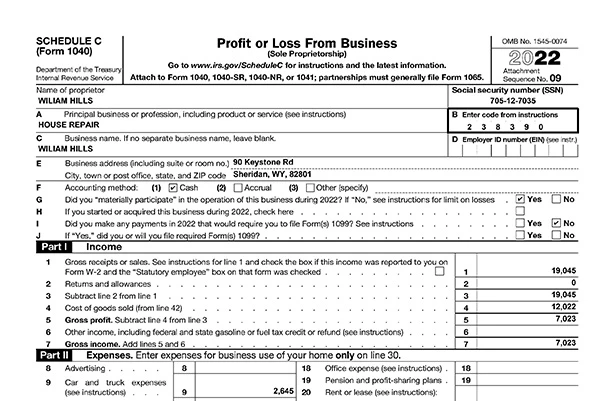

IRS Tax Form 1040 Schedule C, Profit or Loss from Business

The Schedule C (Form 1040) skill extracts data from Schedule C documents used by sole proprietors to report business income or loss on Form 1040.

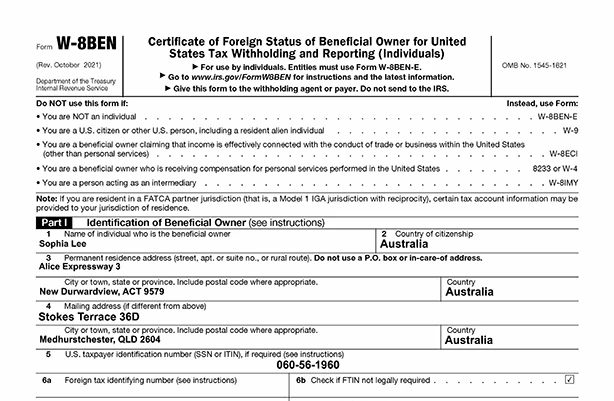

IRS Tax Form W-8BEN

The W8-BEN Form is a form required by the IRS, similar to the W9 form that employees and subcontractors in the United States must submit to employers.

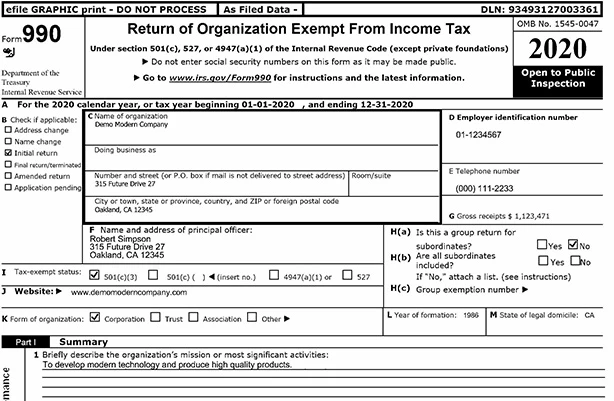

IRS Tax Form 990

The Form 990, Return of Organization Exempt From Income Tax skill extracts data from Forms 990.

Request a demo today!

Schedule a demo and see how ABBYY intelligent automation can transform the way you work—forever.