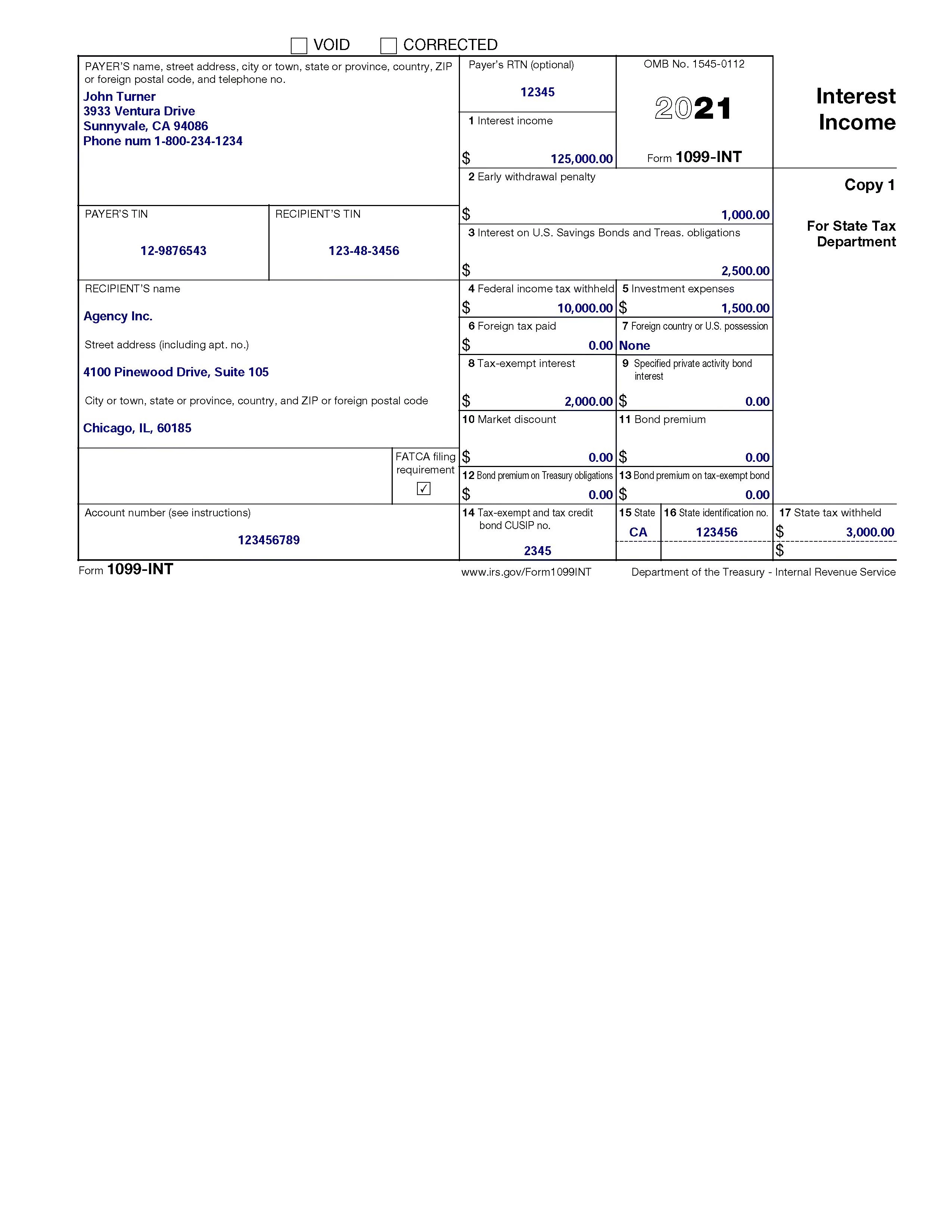

The Form 1099-INT, Interest Income skill extracts data from Forms 1099-INT, which are used to report interest paid in the course of a trade or business. For interest related to securities transactions, the information provided may be different for covered or non-covered transactions: · For covered securities that were acquired at a discount or premium, the payer must either report the net interest amount or separately report the market discount and premium amortization amounts on the Form 1099-INT.

For non-covered securities, the payer is not required to provide information to the taxpayer on any discount or premium. Also, it is solely the responsibility of the taxpayer to account for those amounts on their tax return.

The Form 1099-INT, Interest Income skill is a preview skill. It has been trained on a small document set and is intended to be used by citizen developers as a quick-start basis for processing Forms 1099-INT.

Benefits

- Vantage document skills are extraction models, based on ABBYY's purpose-built AI, designed and trained to extract key data from business documents.

- Preview document skills provide a quick-start basis for conducting proof of concept and automating document-centric processes, without wasting time to train a new skill from the ground up. In most preview skills the main data fields have been labeled and the skill has been trained on a small document set to provide a starting point for further training on customer side. Preview skills generally come at no additional cost, but consume page volume from the base Vantage Core Skills volume.

- Includes validation and data normalization rules. Further business rules can be added as required.

- Can be augmented by human-in-the-loop review and verification based on accuracy thresholds, missing or incorrect information.

- Requires further training in order to ensure sufficient accuracy levels on customer-specific documents. Training can be done up-front or during runtime as documents arrive and go through manual verification.