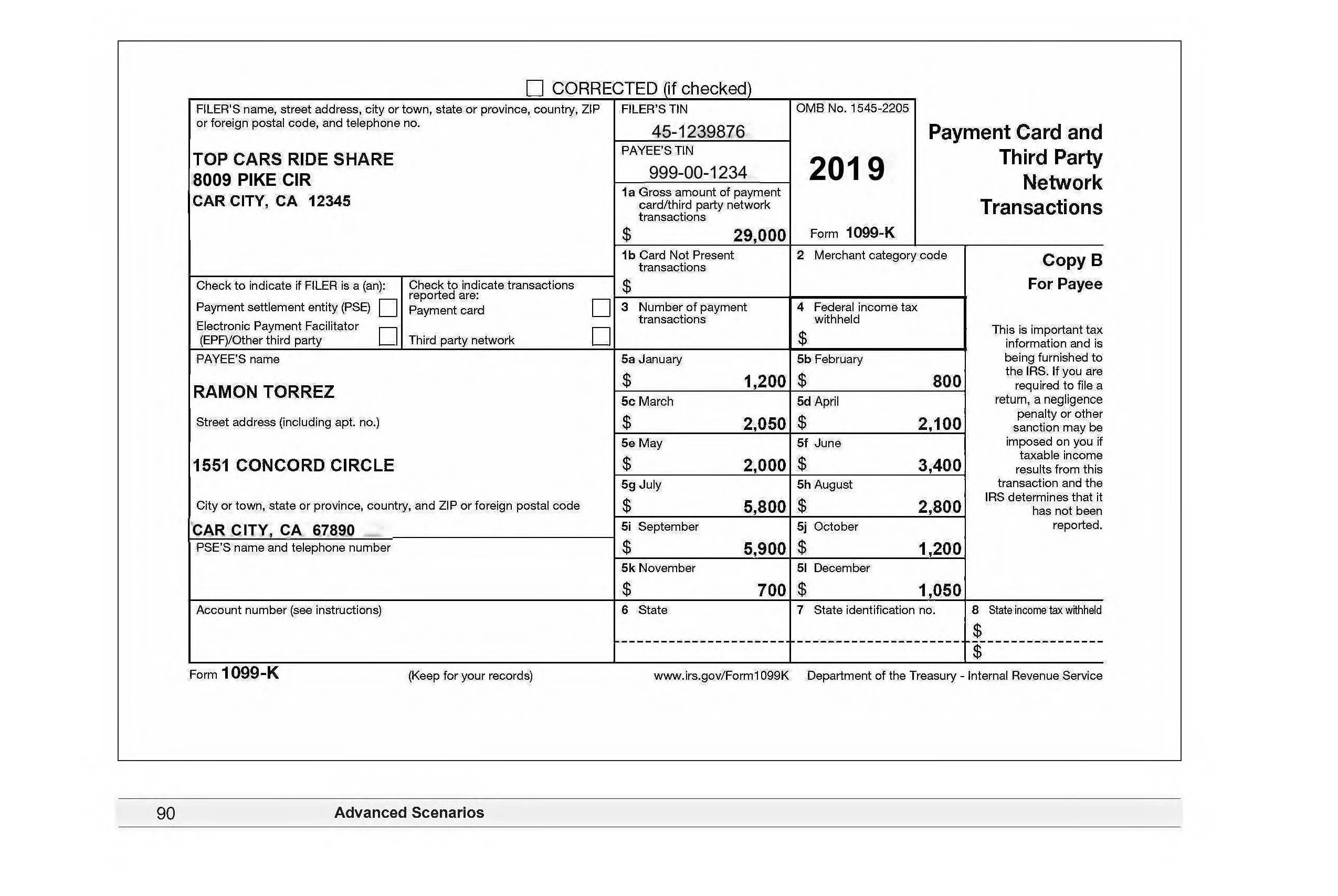

The Form 1099-K, Payment Card and Third Party Network Transactions skill extracts data from Forms 1099-K, which are used to report payments and transactions from payment settlement entities (PSE), that is online platforms, applications or payment card processors.

The Form 1099-K, Payment Card and Third Party Network Transactions skill is a preview skill. It has been trained on a small document set and is intended to be used by citizen developers as a quick-start basis for processing Forms 1099-K. The skill may require further training on your specific documents before it can be used in production.

Benefits

- Vantage document skills are extraction models, based on ABBYY's purpose-built AI, designed and trained to extract key data from business documents.

- Preview Document Skills provide a quick-start basis for conducting proof of concept and automating document-centric processes, without wasting time to train a new skill from the ground up. In most preview skills the main data fields have been labeled and the skill has been trained on a small document set to provide a starting point for further training on customer side. Preview skills generally come at no additional cost, but consume page volume from the base Vantage Core Skills volume.

- Includes validation and data normalization rules. Further business rules can be added as required.

- Can be augmented by human-in-the-loop review and verification based on accuracy thresholds, missing or incorrect information.

- Requires further training in order to ensure sufficient accuracy levels on customer-specific documents. Training can be done up-front or during runtime as documents arrive and go through manual verification.

Processes with this connector

Transfer data to other systems

Related skills

Contributor:

ABBYY

Published:

2 April 2024

Last updated:

2 October 2024

Purchase terms

Free

Specifications

English

United States

Preview