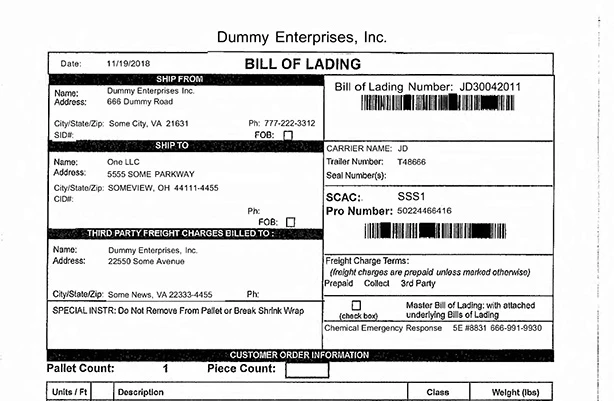

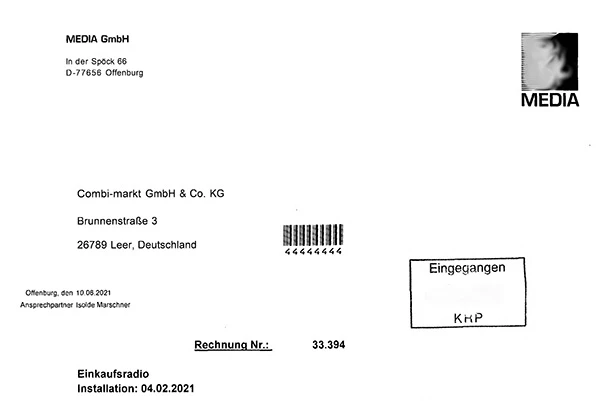

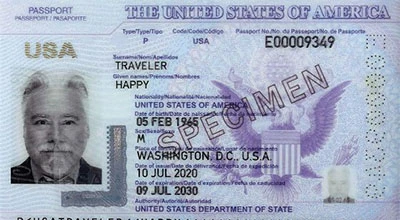

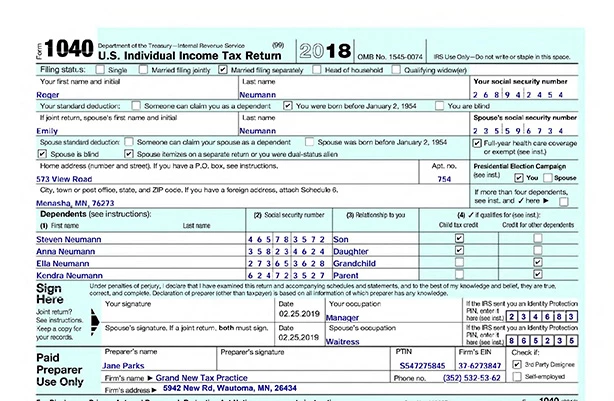

Limitless Automation with Purpose-built AI for Your Documents

Transform your documents into data with ready-to-use AI extraction models and connectors for the ABBYY Vantage intelligent document processing platform.

.png?h=248&iar=0&w=161)

.png?h=64&iar=0&w=65)

Welcome to the ABBYY Marketplace

A wide variety of AI extraction models, connectors, and solutions to expedite document-centric process automation.

.png?h=248&iar=0&w=372)

Purpose-built AI

As a recognized leader in intelligent document processing, we’ve put 30+ years of experience in our low-code IDP platform ABBYY Vantage.

.png?h=248&iar=0&w=371)

.png?h=248&iar=0&w=161)

.png?h=64&iar=0&w=65)

Welcome to the ABBYY Marketplace

A wide variety of AI extraction models, connectors, and solutions to expedite document-centric process automation.

.png?h=248&iar=0&w=372)

Purpose-built AI

As a recognized leader in intelligent document processing, we’ve put 30+ years of experience in our low-code IDP platform ABBYY Vantage.

.png?h=248&iar=0&w=371)

Use cases

Featured assets

A curated collection of assets provided by ABBYY and our partner network to help you speed up your automation initiatives, reduce time to value significantly, and achieve ROI and efficiency improvements.