Vantage 3.0

Introducing a hybrid approach to using Document AI and GenAI

Supercharge AI automation with the power of reliable, accurate OCR

Increase straight-through document processing with data-driven insights

Integrate reliable Document AI in your automation workflows with just a few lines of code

PROCESS UNDERSTANDING

PROCESS OPTIMIZATION

Purpose-built AI for limitless automation.

Kick-start your automation with pre-trained AI extraction models.

Meet our contributors, explore assets, and more.

BY INDUSTRY

BY BUSINESS PROCESS

BY TECHNOLOGY

Build

Integrate advanced text recognition capabilities into your applications and workflows via API.

AI-ready document data for context grounded GenAI output with RAG.

Explore purpose-built AI for Intelligent Automation.

Grow

Connect with peers and experienced OCR, IDP, and AI professionals.

A distinguished title awarded to developers who demonstrate exceptional expertise in ABBYY AI.

Explore

Insights

Implementation

September 5, 2025

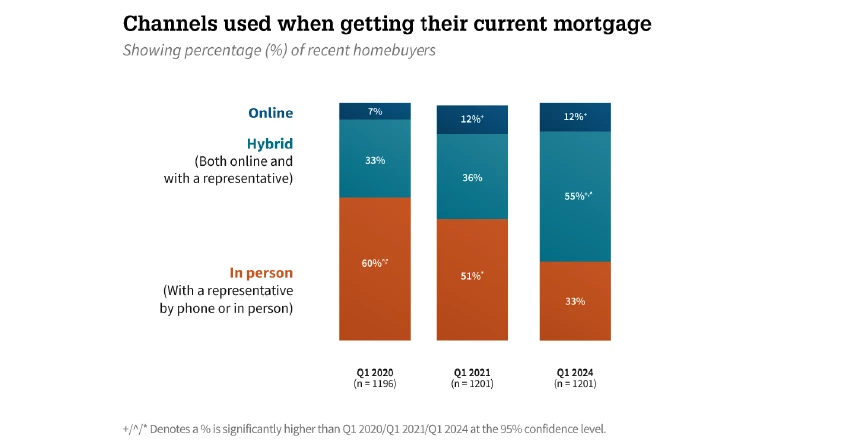

Getting a mortgage used to require manually gathering bank statements and tax documents, followed by weeks of in-person meetings and phone calls with loan officers. Today, most borrowers follow a hybrid process that combines digital tools with traditional steps—and 90% of homebuyers are interested in an even more digital mortgage experience, according to a Fannie Mae survey.

Clearly, lenders and financial services companies need to deliver faster, smoother borrower experiences that match today’s digital-first mindset. But that’s only part of the equation. Behind the scenes, lenders today often rely heavily on manual, time-consuming internal workflows. These also need to be automated for responsiveness and scalability.

To understand what this transformation involves, let’s explore what mortgage process automation is, what benefits it delivers, and which factors lenders should consider when choosing a mortgage loan automation solution.

Jump to:

What is mortgage process automation: Technologies and capabilities

How mortgage automation speeds up decision-making and reduces risk in financial services

What to look for in a mortgage processing automation solution

How AI is reshaping the mortgage industry

Why financial services leaders trust ABBYY for AI-powered mortgage automation

Mortgage process automation refers to the use of technology—including optical character recognition (OCR), natural language processing (NLP), and machine learning—to handle tasks across the mortgage lifecycle that were traditionally performed by humans.

From end to end, the mortgage process is quite intricate and complex. It involves a wide range of documents—loan applications, tax forms, bank statements, disclosures, and credit reports—all of which must be received, classified, and have their data extracted and processed. From this information, lenders must assess risks and make decisions on loan eligibility.

All of this work used to be done manually, but technology has increasingly taken over parts or even entire sections of the mortgage process. Key technologies used in mortgage processing automation include:

What used to be a lengthy mortgage processing workflow can today be completed much faster, thanks to technology performing everything from repetitive tasks to complex calculations—then making data-driven decisions to speed up approvals.

Financial services companies today manage massive volumes of documents from every channel: paper mail, email, even text messages. Fidelity Financial, for example, was handling over 15,000 pages of faxed mortgage applications daily. When manual processing fell short, they turned to ABBYY intelligent automation—and started processing those thousands of pages within an hour of receipt.

Fidelity Financial’s success is just one example of how mortgage process automation helps financial services organizations stay competitive. Here are some of the key ways technology is improving how mortgages are processed:

Beyond faster approvals and fewer manual tasks, mortgage process automation can reveal and eliminate inefficiencies that would otherwise go unnoticed. One global financial institution, for example, uncovered 550,000 hours of rework buried in its mortgage operations. By automating those processes, it reclaimed that time and reduced cycle times by more than six days. Savings on that scale represent a fundamental shift in how mortgage operations are managed altogether.

Many important features now come standard in mortgage automation platforms. Process visibility—through built-in tracking and audit trails—is often included, as are some borrower-friendly tools like mobile and contactless document capture.

But while these features are valuable, they’re not enough on their own. The real differentiators lie in the capabilities that aren’t yet universal. These are the features that deserve the most attention in your evaluation:

Discover how ABBYY helps lenders transform their high-volume, document-intensive loan application and approval processes into easy and efficient flows with mortgage loan automation solutions.

Automation was once focused solely on speed: streamlining tasks to get things done faster. Now, with AI, the mortgage operating model itself is transforming.

With intelligent systems that learn, adapt, and act in real time, mortgage lenders today can deliver more personalized borrower experiences faster and with less risk. Human roles are also shifting from manual review to exception handling and strategic oversight. As AI takes over routine tasks, loan officers and underwriters now have more time to focus on relationship-building and complex decision-making.

In the near future, AI will likely become even more predictive, able to anticipate missing or problematic information before it causes delays, and perform ever more accurate credit assessments by continuously learning from borrower data and market trends.

New advanced AI models are also now changing the governance game in financial services Model Risk Management. While these systems are prone to deliver inconsistent output, new technologies incorporating process intelligence are ensuring that the decisioning being done is without bias, supports compliance standards, and is not leveraging AI decisions that put banks at risk.

Mortgage lending today demands smarter, more reliable ways of working. ABBYY helps you move beyond basic automation with its Document AI platform, powered by purpose-built AI that can understand and process the wide range of documents that drive mortgage decisions.

ABBYY helps lenders streamline mortgage loan processes by transforming these notoriously high-volume, document-intensive processes into easy and efficient flows. Automated document classification and extraction of data at the point of entry enables rapid and accurate transfer of data to scoring systems—greatly improving the customer experience.

What makes ABBYY different from other automation solutions is just how quickly it can deliver a return on investment. With industry-specific, mortgage document processing models that come ready to use, a platform flexible and intuitive enough for non-technical teams to manage, and a capacity to handle high volumes of documents, ABBYY can start delivering measurable results in just days, saving you time and money right out of the gate.

If you’re curious how ABBYY Document AI can transform your mortgage processing, here’s a quick video demo that shows you how it works. For a hands-on walkthrough tailored to your needs, connect with one of our experts to see ABBYY IDP in action.

Visit the ABBYY Marketplace to discover the range of pre-trained document skills that are available for processing mortgage documents such as loan applications, closing disclosures, and more.