Vantage 3.0

Introducing a hybrid approach to using Document AI and GenAI

Supercharge AI automation with the power of reliable, accurate OCR

Increase straight-through document processing with data-driven insights

Integrate reliable Document AI in your automation workflows with just a few lines of code

PROCESS UNDERSTANDING

PROCESS OPTIMIZATION

Purpose-built AI for limitless automation.

Kick-start your automation with pre-trained AI extraction models.

Meet our contributors, explore assets, and more.

BY INDUSTRY

BY BUSINESS PROCESS

BY TECHNOLOGY

Build

Integrate advanced text recognition capabilities into your applications and workflows via API.

AI-ready document data for context grounded GenAI output with RAG.

Explore purpose-built AI for Intelligent Automation.

Grow

Connect with peers and experienced OCR, IDP, and AI professionals.

A distinguished title awarded to developers who demonstrate exceptional expertise in ABBYY AI.

Explore

Insights

Implementation

December 2, 2025

If you’re in the insurance industry, you know that filing a claim often comes at one of the most stressful times in a person’s life—after a car accident, for example. That’s why fast, accurate claims processing matters. It shows clients they’re supported, builds trust, and reduces repetitive work, so your team can focus on the people behind the policies.

Claims processing automation makes that possible. In this blog post, we’ll define what it is, break down the technologies behind it, and explore how it improves speed, accuracy, and the overall claims experience.

Jump to:

What is claims processing automation?

Which technologies play a key role in insurance automation claims processing?

Benefits of automating claims processing

How automated claims processing improves the insurance industry

Automated claims processing in insurance: Use cases

What to look for in an automated insurance claims processing solution

Automated claims processing relies on process intelligence (PI) and intelligent document processing (IDP) in concert with other automations.

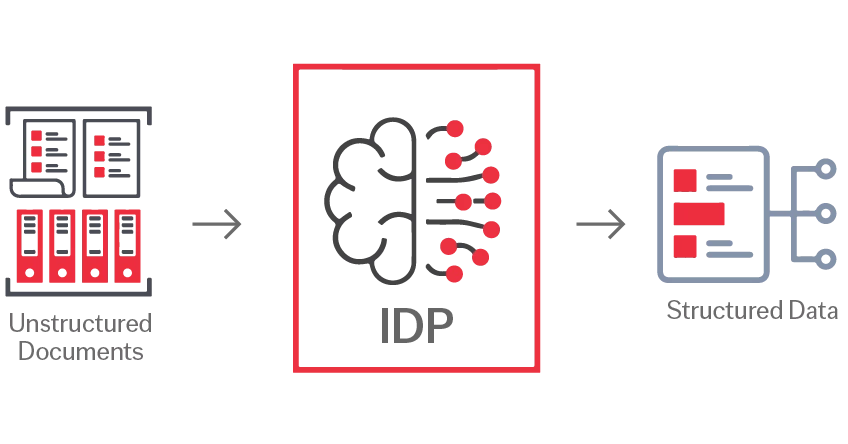

Claims processing automation is the use of technology to speed up and simplify the insurance claims process. It relies on intelligent document processing (IDP), robotic process automation (RPA), optical character recognition (OCR), natural language processing (NLP), process mining, and machine learning to automate tasks such as reading documents, extracting data, classifying information, routing it to the right systems, and tracking workflows in real time.

Automation helps you manage rising claim volumes without scaling headcount at the same rate. You can more easily scale and grow into new markets—or simply handle unexpected spikes in volume—without overwhelming your staff.

Automated claims processing gives your teams more flexibility while keeping operations stable. With digital workflows in place, your claims team can stay efficient whether they’re fully remote, in-office, or somewhere in between.

With automation, your customers can submit documents more easily and quickly. Claims also get processed faster thanks to reduced back and forth, making for quicker resolutions and higher customer retention.

By automating repetitive work, your team has more bandwidth to focus on strategic projects like launching new products or improving customer touchpoints.

Automation powered by AI and process mining helps you adapt quickly. You’ll be able to respond more quickly to new regulations or shifting customer needs.

Watch our demo on Insurance Claims Automation with ABBYY Vantage

In healthcare, automated claims processing reduces the heavy burden of manual data entry and document handling. Intelligent document processing (IDP) extracts structured and unstructured data from medical invoices and insurance claims forms so insurers can quickly and more accurately classify documents, extract data, and keep processes moving.

Auto insurers can streamline claims processes by using IDP to extract key data from accident reports, repair estimates, invoices, and other documents—and checking costs against service agreements. In addition, computer vision can analyze vehicle and odometer photos submitted by policyholders to quickly process image-based information.

In life insurance, insurers can use IDP to handle complex document sets. Tasks like reading beneficiary forms, validating identity documents, and extracting data from death certificates can all be automated to reduce turnaround time and improve accuracy.

Automation can improve how commercial and residential claims are handled from intake to settlement. IDP extracts data from inspection reports, repair estimates, and legal files, while process mining helps identify delays or gaps in workflows. This level of automation can dramatically shorten the time to close claims.

Across all insurance types, common automation use cases include handling customer correspondence, verifying proof of identity, and managing policy servicing tasks. Emails, scanned letters, chatbot interactions, and web form submissions can be automatically digitized, classified, and routed to the right systems or teams. IDP can also create audit-ready records of how documents are processed and linked to specific claims.

Viewed end to end, claims processing is a complex workflow with many interconnected steps that vary depending on the use case. But universally, there are documents that need processing, data extraction, validation, and communication with the claimant—plus ongoing monitoring for compliance and potential fraud.

ABBYY’s automated claims processing solution covers the entire lifecycle from intake to settlement, automating not just individual tasks, but the end-to-end workflow. The combination of IDP, computer vision, and natural language processing enables you to handle complex claims with unstructured content, photos, and handwritten text, all within a single system. In addition, ABBYY’s process mining solutions provide full visibility for continuous process improvement.

If you’re already working with large language models or agentic automation, you already know that these technologies perform only as well as the inputs they receive. Intelligent document processing is now also playing a crucial role in ensuring the accuracy of these AI technologies by providing a data foundation of semantically-rich, structured data from enterprise documents.

With seamless integration to major RPA platforms, core insurance systems, ABBYY’s solutions enable true straight-through processing. If you're looking to automate claims processing, get in touch with one of our experts today.