Vantage 3.0

Introducing a hybrid approach to using Document AI and GenAI

Supercharge AI automation with the power of reliable, accurate OCR

Increase straight-through document processing with data-driven insights

Integrate reliable Document AI in your automation workflows with just a few lines of code

PROCESS UNDERSTANDING

PROCESS OPTIMIZATION

Purpose-built AI for limitless automation.

Kick-start your automation with pre-trained AI extraction models.

Meet our contributors, explore assets, and more.

BY INDUSTRY

BY BUSINESS PROCESS

BY TECHNOLOGY

Build

Integrate advanced text recognition capabilities into your applications and workflows via API.

AI-ready document data for context grounded GenAI output with RAG.

Explore purpose-built AI for Intelligent Automation.

Grow

Connect with peers and experienced OCR, IDP, and AI professionals.

A distinguished title awarded to developers who demonstrate exceptional expertise in ABBYY AI.

Explore

Insights

Implementation

November 13, 2025

For financial institutions, falling behind on compliance has become an incredibly expensive problem in recent years. In the first half of 2025 alone, regulators globally issued $1.23 billion in fines related to anti–money laundering (AML), Know Your Customer (KYC), sanctions, Suspicious Activity Reports (SARs), and transaction monitoring violations.

Digital fraud like synthetic IDs and phishing scams is rising sharply, and regulators are responding with tougher oversight and record fines. Yet, many financial institutions still rely on fragmented compliance processes built on manual reviews, legacy systems, and inconsistent data validation. These approaches don’t just slow down onboarding—they create gaps that regulators penalize and auditors flag.

The problem is compounded by the sophistication of modern fraud. With the tools fraudsters now have at hand, it’s nearly impossible for human reviewers to reliably spot forged or manipulated documents. Manual review is no longer just inefficient—it’s insufficient to protect institutions from financial crime and regulatory risk.

Advances in AI-driven technology now offer a way forward. Document AI helps financial institutions replace fragmented workflows with automated data capture, validation, and monitoring. Instead of reacting to gaps, compliance teams can maintain consistent, auditable processes that scale with regulatory demands. With rules tightening every year, understanding today’s compliance landscape is the first step toward seeing where Document AI and Process AI can make the greatest impact.

Jump to:

From defensive to proactive compliance in financial services

Document AI for KYC compliance: Faster, safer onboarding

Document AI for AML: Stronger monitoring with fewer gaps

How Process AI supports KYC and AML

How to evaluate Document AI solutions for AML and KYC compliance

Trends and innovations in AML and KYC compliance

Use cases: Document AI and Process AI in action

Why ABBYY sets the standard in Document AI for AML and KYC compliance

Compliance was once viewed primarily as a defensive function, a necessary cost to avoid penalties. Yet, today’s tougher regulations and rising fines mean banks are watched closely by regulators and investors alike. Leading institutions now treat good compliance as a strategic advantage that proactively signals reliability and resilience.

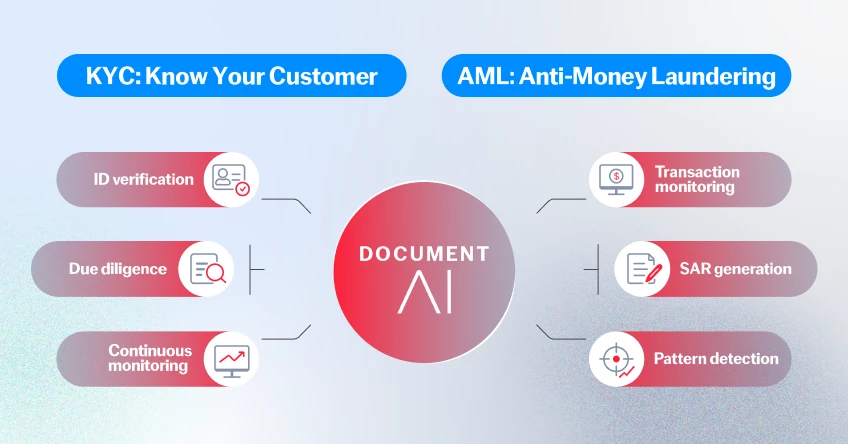

Document AI, in combination with advanced AI-based document forensics providers, is helping banks make this shift in two critical areas:

Process intelligence adds another layer of protection by revealing how customers and employees interact with processes and documents in real-time. This helps spot process loopholes and potential fraud risks so financial institutions can counter vulnerabilities before they lead to problems.

Customer onboarding has become one of the most resource-intensive parts of compliance in financial services, but Document AI can be used to automate many core KYC tasks:

With Document AI, institutions can onboard customers faster while lowering error rates and strengthening regulatory compliance.

Anti-money laundering compliance requires processing vast amounts of data, often spread across multiple systems. Document AI helps compliance teams complete this work much more quickly and accurately by automating:

Together, these capabilities speed up AML programs, so compliance teams can spend more of their time on higher-value analysis.

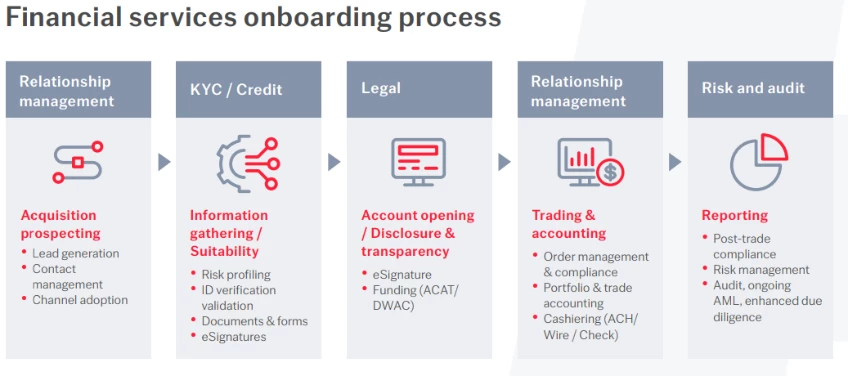

Document AI covers even more ground when combined with Process AI. While Document AI delivers cleaner, more accurate data into compliance systems, Process AI focuses on how that data moves through the entire KYC and AML lifecycle.

In KYC, Document AI captures and validates customer IDs and proof of address alongside corporate documents. Process AI then tracks the onboarding workflow end-to-end to reveal any bottlenecks in the workflow and prove that every customer followed the required steps. Ultimately, Process AI makes KYC workflows consistent, traceable, and auditable across thousands of customers.

In AML, Document AI provides structured identity data that feeds transaction monitoring, sanctions screening, and SAR reporting. Process AI puts that data to use by continuously analyzing how CDD, EDD, and PEP screening are performed. This highlights any compliance gaps and can even simulate the impact of new regulations on workflows. In practice, Process AI can show regulators both that customer data is accurate and that the compliance processes themselves are actively monitored and optimized against risk.

Your compliance teams process a wide variety of documents, ranging from passports to corporate records that span multiple jurisdictions. Make sure the Document AI you choose can process all the formats and languages your team sees, or else they’ll have to create manual workarounds that increase the chance of errors.

Even when documents arrive in blurry or low-quality formats, your solution needs to extract data reliably. Otherwise, your team will not know if they can trust the results and will often have to revert to manual review.

Look for AI-driven document forensic capabilities like metadata analysis, liveness checks, and tamper detection that can detect modern forms of document forgery and manipulation. Without these, you risk passing through fraudulent documents that expose you to regulatory penalties.

Make sure your solution can provide auditors with proof that every step was handled correctly through traceable, auditable records. You need a system that explains its outputs, rather than acting like a black box.

Look for Document AI that fits into your existing compliance stack, not one that forces you to adapt to it. Platforms that don’t integrate or that lock data in proprietary formats will drag down efficiency.

Your Document AI solution should be able to quickly adjust to new compliance requirements so you can easily update controls in response to industry changes.

To keep your compliance up-to-date as business needs change, pick a solution that uses machine learning to adapt, improve accuracy, and detect emerging fraud patterns.

As regulatory requirements evolve, technology too is changing quickly to restructure compliance processes altogether. Notable advances include:

Financial institutions are finding new and creative ways to apply Document AI to compliance challenges. Let’s take a look at a few specific examples:

ABBYY Document AI is purpose-built for the realities of financial compliance. It applies pre-trained, compliance-specific AI models that can handle complex document types and multi-page corporate records in multiple languages. Its advanced semantic analysis and context-aware data validation give compliance teams complete, structured, and auditable data without reverting to manual reviews.

In addition, ABBYY Document AI plugs easily into existing compliance workflows to process forms with speed and accuracy. Its low-code configuration lets institutions adjust rapidly when regulatory requirements change, too. Companies can confidently power their AML and KYC programs, catching risks earlier and staying audit-ready while onboarding customers faster.

To get specifics on how ABBYY Document AI can support AML and KYC compliance for your institution, get in touch with one of our experts.

AI can automate the most manual and error-prone parts of the compliance process. Instead of relying on human teams to review IDs and cross-check data, AI can extract and validate information at scale to spot anomalies in real time, reducing costs and speeding customer onboarding. More importantly from a compliance perspective, institutions can reduce the risk of missed red flags and respond faster to changing regulations.

Document AI can capture and validate data consistently across every customer interaction. It can automatically check to make sure all fields and formats are complete while creating an auditable trail for regulators, work that would otherwise be slow and prone to errors if performed manually. By embedding rules for KYC, AML, and other regulatory checks directly into workflows, Document AI helps institutions standardize, speed up, and improve accuracy for compliance processes.

For regulated industries, IDP offers accuracy and consistency for compliance processes. Every form and ID can be captured, validated, and logged the same way every time. Instead of patchy manual checks, institutions get complete records and audit trails regulators can trust.