Vantage 3.0

Introducing a hybrid approach to using Document AI and GenAI

Supercharge AI automation with the power of reliable, accurate OCR

Increase straight-through document processing with data-driven insights

Integrate reliable Document AI in your automation workflows with just a few lines of code

PROCESS UNDERSTANDING

PROCESS OPTIMIZATION

Purpose-built AI for limitless automation.

Kick-start your automation with pre-trained AI extraction models.

Meet our contributors, explore assets, and more.

BY INDUSTRY

BY BUSINESS PROCESS

BY TECHNOLOGY

Build

Integrate advanced text recognition capabilities into your applications and workflows via API.

AI-ready document data for context grounded GenAI output with RAG.

Explore purpose-built AI for Intelligent Automation.

Grow

Connect with peers and experienced OCR, IDP, and AI professionals.

A distinguished title awarded to developers who demonstrate exceptional expertise in ABBYY AI.

Explore

Insights

Implementation

October 11, 2024

Organizations process 560 billion invoices annually with 125 billion of these being electronic. Hybrid invoicing remains common due to multiple channels yet electronic invoicing trends upward. Two main factors drive e-invoicing adoption:

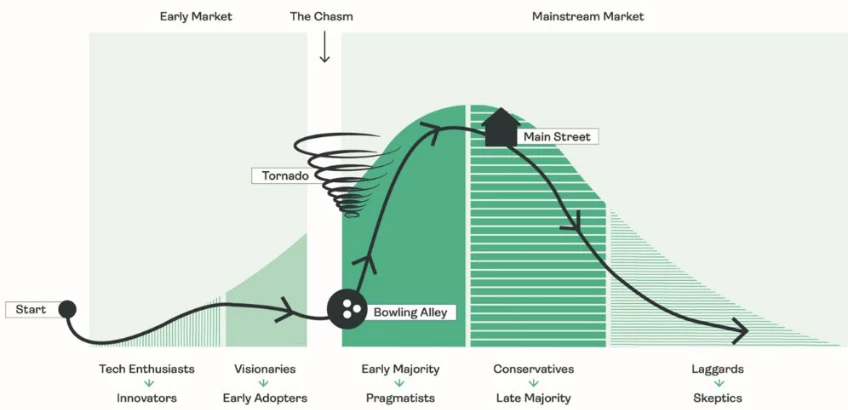

E-invoicing is in a high-demand phase that can be described as a “tornado” as illustrated in Billentis' report on Global e-Invoicing and Tax Compliance.

The concept of a “tornado” is an early phase of the lifecycle where a specific solution for a specific challenge is in high demand – this is where e-invoicing currently is. As mandates approach, this need becomes increasingly pressing.

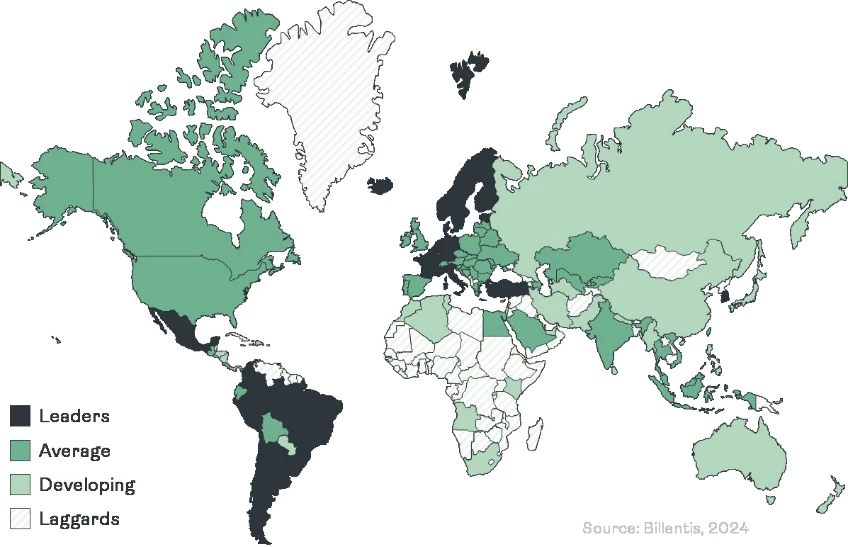

The below map describes the varying maturity of different countries with respect to e-invoicing.

Historically, Latin America has driven e-invoicing, with Europe close behind. However, there is growth in all regions for consumer and business e-invoicing alike. The APAC region is currently exhibiting hyper-growth, particularly for consumer e-invoicing like e-receipts.

Globally, new e-invoicing obligations are emerging, affecting over 70 countries. Awareness of these obligations remains low among businesses. Reporting requirements can be categorized into four models:

With Latin America ahead in e-invoicing, future developments point toward integrated digital trade. This comprehensive approach encompasses P2P, audit, and cash processes, anticipating a doubling of e-invoices by 2028. Complete compliance with e-invoicing mandates may take until 2030, with PDFs remaining in use. Integrated Document Processing (IDP) extends beyond structured documents.

AI is transforming e-invoicing quietly but effectively by automating data capture, extraction, fraud detection, and predictive analysis. Although not yet solving all challenges, AI considerably enhances efficiency and accuracy while increasing businesses’ ability to handle widely varying e-invoice formats.

Multinational companies often employ numerous service providers for invoice processing. E-invoicing adoption may lead to consolidation, reducing the number of providers. Harmonizing international processes, systems, and tax requirements presents further difficulty; therefore, proactive compliance strategies, internal awareness, and clear guidelines are crucial for large organizations.

For e-invoicing optimization in large organizations, it’s important to centralize the process to have an overview of inbound and outbound invoices as well as the systems used as part of the process. Paper should then be replaced as much as possible with electronic invoices before finally beginning to cover the whole process (integrated digital trade).

Many of these projects start with looking at the outbound process. Nevertheless, businesses must consider other parts of the process like intercompany billing, which is often overlooked and underestimated. Businesses have 100% control of this process, so it can easily be changed. Inbound processes entail purchasing power with asking suppliers to provide information in a certain way, enabling further savings.

Processing international invoices entails different document formats, making human validation much more difficult. E-invoices are still created by humans and filled with data provided by humans; therefore, errors are unavoidable – as many as 12% of e-invoices contain errors.

ABBYY allows businesses to integrate e-invoices within their AP automation, enabling the following capabilities:

By leveraging intelligent automation in your e-invoicing processes, you can achieve transformative outcomes such as:

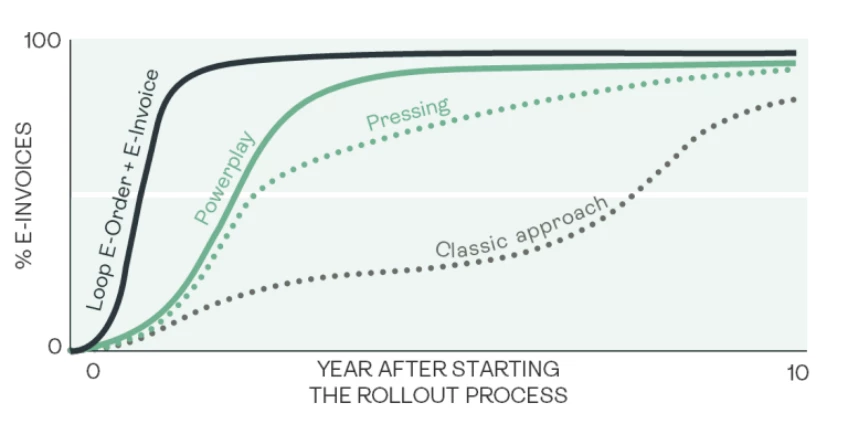

The best recommendation you can receive is simply to start e-invoicing now. Considering the complexity of supporting tax authorities, connecting internally and with partners, suppliers, and customers, an early start is essential.

ABBYY recently hosted four webinars for our yearly Intelligent Automation Month. This session on incoming e-invoicing mandates featured insights from ABBYY AI Ethics Evangelist Andrew Pery, ABBYY VP of Product Management Andrew Zyuzin, and Billentis Owner and CEO Marcus Laube. To explore this topic in greater detail request access to a recording.

Interested in intelligent automation solutions but not sure where to start? Tell us about your business process challenges, and we can find a solution together. We look forward to learning about your digital transformation journey.