Vantage 3.0

Introducing a hybrid approach to using Document AI and GenAI

Supercharge AI automation with the power of reliable, accurate OCR

Increase straight-through document processing with data-driven insights

Integrate reliable Document AI in your automation workflows with just a few lines of code

PROCESS UNDERSTANDING

PROCESS OPTIMIZATION

Purpose-built AI for limitless automation.

Kick-start your automation with pre-trained AI extraction models.

Meet our contributors, explore assets, and more.

BY INDUSTRY

BY BUSINESS PROCESS

BY TECHNOLOGY

Build

Integrate advanced text recognition capabilities into your applications and workflows via API.

AI-ready document data for context grounded GenAI output with RAG.

Explore purpose-built AI for Intelligent Automation.

Grow

Connect with peers and experienced OCR, IDP, and AI professionals.

A distinguished title awarded to developers who demonstrate exceptional expertise in ABBYY AI.

Explore

Insights

Implementation

December 12, 2025

E-invoicing is just the latest example of how external disruptions reshape the finance landscape. For many, this mandate presents yet another instance of outside pressure imposing new requirements. But looked at differently, e-invoicing offers a unique opportunity: it exposes where our existing processes struggle with complexity and where legacy workflows are overdue for a reset. By using such disruption as a catalyst, organizations can lay the groundwork for transformation—preparing not only to comply, but to thrive in the face of future change.

This is more than an exercise in digitizing invoices. It’s a moment to re-examine the whole structure of financial operations, turning a compliance obligation into a strategic lever. The processes and systems we build now position us to embrace agentic automation and move from reactive change to proactive strategy.

Jump to:

The foundation: reliable, structured accessible data

The context: truly understanding processes

When new regulations upend established routines, it’s natural to see them as an additional burden. E-invoicing, with its complexity, lack of clarity, and shifting deadlines and data exchange requirements, can seem especially disruptive. Adapting to new formats, integrating reporting systems, and updating controls is demanding work, and the immediate benefit is often unclear—appearing to serve primarily external stakeholders like tax authorities.

But e-invoicing’s true value lies in what it reveals: an environment filled with disconnected documents, manual interventions, and patchwork data streams. Contracts, purchase orders, and payment advices remain scattered across paper, PDF, email, and hybrid sources. Addressing just the e-invoice layer without tackling these other workflows creates a fragmented, fragile process—one that reacts to the latest regulation but remains exposed to future disruptions.

This realization is our cue to act: to use the current challenge as a springboard for strategic process redesign. Only by addressing these end-to-end complexities—transforming not just one document flow, but the broader data landscape—can we build systems robust enough for tomorrow’s demands.

Regulatory mandates like e-invoicing solve for a single document type, but they leave dozens of others untouched. Workflows for purchase orders, shipping notices, and customs declarations remain dependent on manual data entry, creating blind spots that slow down operations and consume scarce resources. This fragmented approach fails to deliver end-to-end visibility and control.

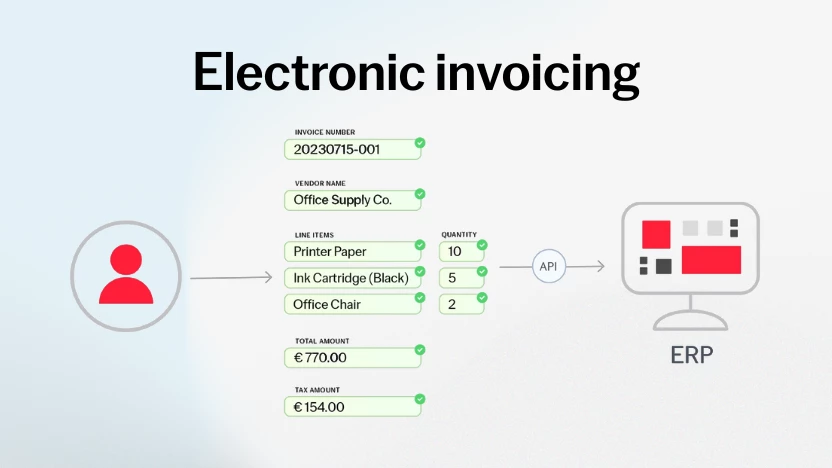

Intelligent document processing (IDP) confronts this challenge directly by creating a unified data layer for all document-based operations:

By structuring all trade and finance documents, not just one, IDP builds a comprehensive, reliable data foundation. This gives organizations a single source of truth that enables true resilience and adaptability, no matter what new requirements appear.

External disruptions are seldom one-dimensional. Financial workflows like Procure-to-Pay and Record-to-Report are built from intricate dependencies, conditional steps, and human decision points. Without clarity into how these processes actually run, change initiatives tend to add new layers of complexity—rather than simplifying and strengthening the operation.

Process intelligence (PI) brings this needed transparency. Instead of relying on assumptions or outdated diagrams, PI draws a live map of processes using real event data from your systems:

Armed with these insights, finance leaders can address not only the current regulatory disruption—but anticipate and design for what’s next. This is how organizations move from reactive firefighting to strategic process management.

By aligning on proven data and process foundations, organizations can take full advantage of technological leaps like agentic automation. Agentic AI is not replacing people, it is creating workflows that are agile, responsive, and fit for continuous evolution.

With structured data from IDP and clear process context from PI, agentic systems can take over steps that with traditional automation methods required human intervention:

Rather than viewing disruption as a threat, organizations now have the tools to see it as a test of readiness—and a chance to surface new efficiencies at scale.

Every new regulation, like e-invoicing, is a reminder that external forces will continue to unsettle established routines. They surface hidden weaknesses, focus attention on root causes, and provide momentum for much-needed change.

By shifting from a mindset of compliance as defense to one of strategic readiness, organizations build resilience for the challenges ahead. A three-layered approach—trusted data through IDP, verified context with PI, and intelligent action from agentic systems—offers a repeatable path for turning today’s mandate into tomorrow’s advantage.