Innovation vs. commoditization: understanding millennials in banking & financial services

September 14, 2017

My generation of 2.5 billion millennials around the world will soon have the collective capacity to generate $1.4 trillion of purchasing power by 2025. There are 92 million millennials in America today, the biggest generation in US history, even more than the Baby Boomers. It’s obvious why banks and financial service institutions are keeping a sharp eye on the millennial demographic.

One of the largest generations in history is about to move into its prime spending years. Millennials are poised to reshape the economy; their unique experiences will change the ways we buy and sell, forcing companies to examine how they do business for decades to come.

Goldman Sachs

While the possibilities are exciting, the two most common ages in 2016 were 19 years old (4,585,234) and 50 years old (4,660,295), basically millennials and Baby Boomers.

Baby Boomers were once considered the technological future of their generation’s time. Their need to go inside a branch dwindled as wide-spread innovation began with the Automated Teller Machine (ATM), creating 3.5 million ATMs around the world. However, this pales in comparison to the 4.77 billion global mobile phone users in 2017 and how millennials interact with their finances today:

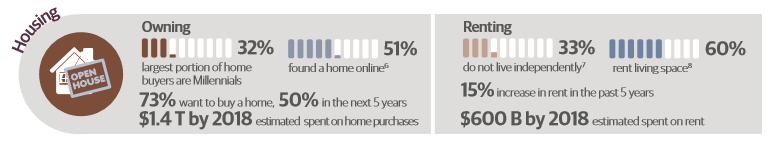

50% of millennials transfer money digitally, and that 50% are looking spend $1.4 trillion solely on home purchases by 2018

To stand out, banking and financial services institutions must overcome the commoditization of app-based services and further innovate to provide their clients even better and more personalized premium self-service experiences on mobile devices.

Innovation vs. commoditization: why automation doesn’t fix everything

My house lights and fans are automated through Amazon’s Alexa. My security cameras are automated through the cloud. My payments are fully automated through my mobile apps. Automation has embedded itself in our lives, and the idea of visiting a bank branch is an antiquated thought.

For millennials, innovative bank or financial service performance is less about the physical branch, and more about premium self-service. We expect 24/7 real-time access and service from the organizations and providers we engage with. Innovation goes beyond the simple automation of processes in the back office, by bringing the front office directly to mobile devices and letting millennials process things on their own time.

Intelligent capture drives cost reduction & improved customer services

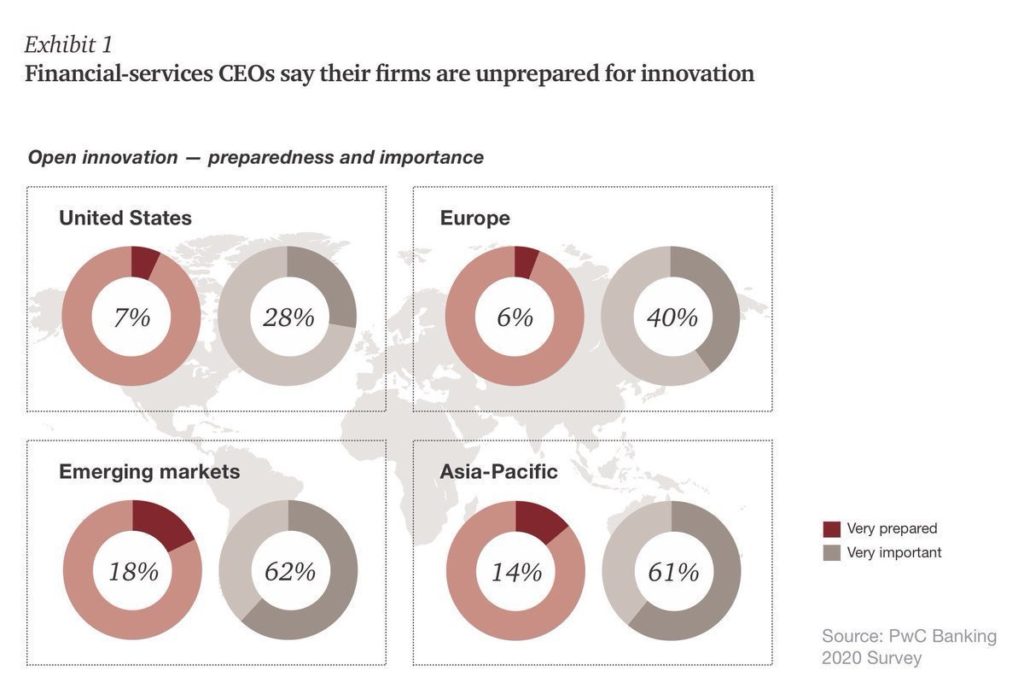

Sadly, PwC notes that only 7% of US-based CEOs consider themselves prepared for innovation:

Banks and financial services institutions are under increasing pressure to contain costs and improve service quality, but that is difficult to do when the existing infrastructure is dependent on outdated, paper-based workflows. Intelligent data capture, document classification, and unstructured content extraction solutions on mobile, on-site, and in the cloud, enable millennials in real-time.

Author’s note:

I am currently 28 and my parents are 55. This places me in the millennial bracket (born 1980-1999) and my parents in the Baby Boomers generation (born 1946-1964), both the two largest segments of the US population as seen in this graph from CNN Money.

Derek Gerber

Subscribe for blog updates

- Understanding FSQS Certification and Its Importance for Financial Institutions

- Document Automation as Game-Changer across Industries

- ABBYY DevCon Hackathon 2025 Doubles Down on AI Innovation