Invoice processing once meant hours spent manually sorting, verifying, and keying in numbers—then chasing down approvals across departments. Today, automation often does the heavy lifting. Invoice automation can capture, extract, and validate key data, then send that information directly to business systems for straight-through processing.

In this guide, we’ll look at how automated invoice processing works, what its key benefits are, and how you can choose the right processing solution for your business.

Jump to:

What is automated invoice processing?

Benefits of automated invoice processing

How to automate invoice processing

How to choose the right invoice automation software

What is automated invoice processing?

Automated invoice processing is the use of software to capture, extract, validate, and integrate invoice data into business processes.

Without automation, businesses typically rely on staff to manually enter data, verify details, route approvals, process payments, and organize records for future reference—all of which can be time-consuming and error-prone. Automation speeds up the process by performing tasks such as:

- Data analysis and extraction

- Data validation and verification

- Exceptions handling

- Workflow management

- Approval and payment

A key technology used in automated invoice processing is optical character recognition (OCR), which extracts key details—such as vendor names, invoice numbers, dates, line items, and totals—from invoices without requiring manual data entry.

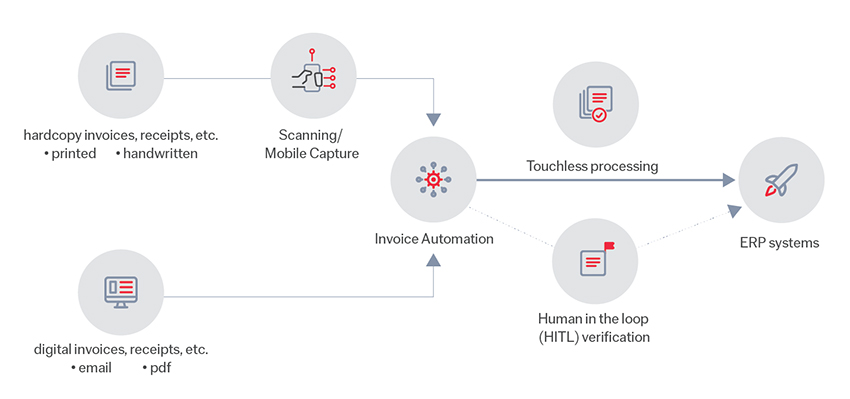

When combined with AI technologies such as machine learning (ML) and natural language processing (NLP), automated invoice processing gets smarter to efficiently process even unstructured PDFs and handwritten receipts—whether they arrive via paper, email, API, mobile, or scanning. ML enables the system to identify patterns and continuously improve accuracy by learning from past corrections, while NLP helps understand context and adapt to new formats without manual intervention.

How invoice automation works

The exact workflow of automated invoice processing depends on the solution you choose. Intelligent document processing (IDP) solutions powered by AI, for example, can go beyond basic, rule-based automation to handle more complex tasks and continuously improve accuracy. These solutions deliver the data to the company’s information systems such as RPA, BPM, and ERP to facilitate straight-through processing of invoices. No matter the channel that invoices arrive—paper, email, API, MFP/local scanning, mobile device, web-based scanning—all invoices are processed centrally. Here’s how the process typically works:

- Scanning and data extraction: Physical and digital invoices are scanned or uploaded into the system. OCR technology captures relevant information from the invoices, such as vendor details, invoice numbers, dates, line items, and amounts.

- Data validation: Extracted data is validated against predefined rules and criteria to catch any mistakes or inconsistencies.

- Matching and verification: The system automatically cross-references invoice data with purchase orders (POs) to confirm that the goods or services were received.

- Exception handling: Any discrepancies or exceptions are flagged for further investigation and resolution.

- Workflow management: Invoices are routed through the right departments or individuals for review and approval, based on company rules and hierarchies.

- Payment: Once approved, the system triggers the payment process. This might involve generating payment instructions, updating accounting records, and initiating the actual payment to the vendor.

Benefits of automated invoice processing

Automation improves invoice processing not just by speeding up and streamlining your workflows, but by giving you stronger financial controls and better oversight. Advantages include:

Efficiency

Automating invoice processing eliminates unnecessary steps, reduces bottlenecks, standardizes processes, and streamlines decision-making for a faster, more consistent workflow with less friction. Invoice records can be easily centralized for quicker access and stronger security. Streamlining accounts also involves identifying and eliminating potential sources of errors, while standardizing processes ensures that tasks are carried out in a consistent manner.

With AI-powered automated invoice processing, companies can see as much as a 90% improvement in invoice processing times, with straight-through processing reducing tasks that once took a day or two to under an hour. Employee productivity also goes up by as much as 400%, and accounts staff spend 30% less time on queries, freeing them to focus on higher-value tasks.

Accuracy

Humans often make mistakes when repetitively reading, entering, or verifying data. Automating invoice processing eliminates this risk. With three-way matching, the system automatically cross-checks the purchase order, goods received report, and invoice for quantity and pricing—preventing overpayments, underpayments, late or duplicate payments, and other mistakes while improving consistency and efficiency.

Compliance

Automated invoice processing enforces approval workflows, maintains a clear audit trail, and validates invoices to reduce fraud and errors. By processing invoices according to company policies and regulatory standards, it helps businesses meet tax, financial, and industry compliance requirements while minimizing penalties.

Cost savings

Cost savings are a key driver for switching to automated invoice processing, with businesses seeing up to 91% lower processing costs. Recent surveys suggest that the median AP cost per invoice is $11, while best-in-class companies spend just $3 or less per invoice. Invoice automation also helps organizations save money by helping them take advantage of early payment discounts.

Visibility

Automation provides real-time tracking and reporting on the status of invoices so businesses can keep track of outstanding payments, forecast expenses, and make more informed financial decisions.

How to automate invoice processing

1. Choose an invoice processing solution

Choose a turnkey automated invoice processing solution that captures, recognizes, extracts, and validates data to make straight-through processing of PO-based invoices easy and accurate.

2. Customize the workflow

Be strategic when designing the steps and decisions involved in your invoice processing workflow. Customize and configure your process to match the unique requirements, preferences, and constraints of your organization.

3. Integrate with existing systems

Leading invoice processing software providers offer free connectors for fast, low-cost integration with top enterprise resource planning (ERP) and accounting systems. Integrate your invoice automation solution with your existing infrastructure so that extracted and verified invoice data is delivered directly to your existing systems—including robotic process automation (RPA), customer relationship management (CRM), business process management (BPM), enterprise content management (ECM), and accounting platforms—creating a smarter, end-to-end automated accounts payable workflow.

4. Test and review

Test customized workflows in a controlled environment, gather feedback, and make necessary adjustments. As business needs evolve, continuously monitor the workflow's performance to analyze its effectiveness and make further optimizations to stay relevant and effective.

How to choose the right invoice automation software

Selecting the right invoice automation software for your business is central to improving efficiency and accuracy. Here’s what to look for when evaluating your options:

- Integration capabilities: Make sure the software integrates seamlessly with your ERP, accounting, and other systems to automate data flow.

- Ease of use: Look for an intuitive, user-friendly interface that requires minimal training, with low-code/no-code (LCNC) capabilities that allow teams to customize workflows without technical expertise. Mobile access should enable on-the-go invoice tracking and approval, ensuring seamless processing from any device.

- Automation features: Seek automatic data capture, invoice matching, and approval workflows to reduce manual tasks and speed up the invoice processing cycle.

- Data extraction: The software should include high-accuracy OCR with pre-trained extraction models to extract key data from scanned or photographed invoices.

- Validation and approval workflows: Ensure the software can accurately match invoices with POs and receipts and allow for multi-level approvals and notifications.

- Security and compliance: Choose software that meets industry standards for data security and compliance, especially for sensitive financial information.

- Customization and scalability: The software should allow you to customize fields and workflows—and be able to handle increasing invoice volumes to adapt to changing business needs.

- Reporting and analytics: Look for a solution that provides insights into invoice processing times, approval bottlenecks, and other key performance metrics to optimize efficiency.

- Vendor support: Evaluate the level of customer support offered. Make sure you can get timely assistance with troubleshooting and customization.

- Cost and ROI: Assess the software's cost against potential time and cost savings. Calculate the return on investment (ROI) based on efficiency gains.

Examples of automated invoice processing

- Healthcare: Automate medical supplier invoice processing by seamlessly matching them with POs and goods receipts. By reducing manual review, the system improves tracking of vendor contracts and compliance with healthcare regulations while making sure payments are only made for received items.

- Insurance: Extract and validate data from claims-related invoices, matching them with policy details and provider information to reduce errors and speed up the approval process for a faster customer experience.

- Logistics and supply chain: Reduce administrative workloads in transportation and logistics and make quicker, more accurate payments to carriers by automatically matching shipment and delivery invoices with delivery orders and tracking data.

- Government and public sector: Manage contracts and purchases consistently across departments by automatically routing procurement invoice approval workflows in compliance with budget and regulatory standards.

Why choose ABBYY to automate invoice processing?

ABBYY’s industry-leading AI-powered invoice processing software delivers speed, accuracy, and efficiency at scale, offering:

- Best-in-class AI and OCR: Industry-leading OCR and purpose-built AI ensure high-accuracy data extraction from any invoice format, in any language. AI-powered fraud detection helps identify anomalies, duplicate invoices, and suspicious transactions before payments are processed.

- Seamless integration and scaling: Pre-built connectors and low-code integration let you connect ABBYY with ERP, RPA, BPM, and accounting platforms for smooth workflows. ABBYY’s solution also adapts to growing business needs with cloud, on-premise, and API deployment options.

- Low-code/no-code (LCNC): Business users can configure workflows and build custom models even without technical expertise, making automation more accessible and adaptable to changing business needs.

- Fast implementation and ROI: Get started quickly with pre-trained AI models, achieving 90%+ accuracy from day one and improve accuracy over time, reducing manual corrections and increasing efficiency.

That combination of advantages translates to real results for ABBYY clients. Take GEMLUX, a leading marine hardware manufacturer. Before automation, the company’s manual purchase order processing required sales reps to spend 30–45 minutes entering POs—some with more than 100 line items—while consolidating supplier orders could take an entire day. By integrating ABBYY intelligent document processing (IDP) with NetSuite ERP, GEMLUX reduced PO processing to just 3–5 minutes. Supplier order management became 75% faster too. With ABBYY IDP in place, GEMLUX is now expanding automation to other document workflows.

Every company has unique challenges, and ABBYY’s purpose-built AI solution adapts to different needs with pre-trained models tailored to specific industries. If you’re ready to see how ABBYY can optimize your invoice processing, request a demo with one of our experts today.