Vantage 3.0

Introducing a hybrid approach to using Document AI and GenAI

Supercharge AI automation with the power of reliable, accurate OCR

Increase straight-through document processing with data-driven insights

Integrate reliable Document AI in your automation workflows with just a few lines of code

PROCESS UNDERSTANDING

PROCESS OPTIMIZATION

Purpose-built AI for limitless automation.

Kick-start your automation with pre-trained AI extraction models.

Meet our contributors, explore assets, and more.

BY INDUSTRY

BY BUSINESS PROCESS

BY TECHNOLOGY

Build

Integrate advanced text recognition capabilities into your applications and workflows via API.

AI-ready document data for context grounded GenAI output with RAG.

Explore purpose-built AI for Intelligent Automation.

Grow

Connect with peers and experienced OCR, IDP, and AI professionals.

A distinguished title awarded to developers who demonstrate exceptional expertise in ABBYY AI.

Explore

Insights

Implementation

January 30, 2026

Every day, thousands of people start a customer onboarding process, and never finish it. Research shows that nine in ten organizations face onboarding abandonment rates of up to 40%, and a further 5% admit they have no visibility into where customers are dropping off.

Source: ABBYY, State of Intelligent Automation Report

That makes your onboarding process both an opportunity and a risk. You want this first point of interaction to be quick and intuitive, but you also can’t skip the essentials in the rush to speed things up. Companies still need to collect accurate data to verify identities, prevent fraud, meet compliance data, and personalize experiences.

Document AI bridges this gap between customer wants and business needs. When you automate customer onboarding with Document AI, you remove burdensome steps for your customers, while improving accuracy in the process. With ABBYY Document AI, you can move beyond basic onboarding automation to give systems the ability to understand what’s inside customer documents and route them intelligently in real time.

Let’s look at what isn’t working in traditional customer onboarding, how Document AI solves these challenges, and how it’s changing onboarding processes across industries.

Jump to:

What’s wrong with traditional customer onboarding processes

Common points of friction in customer onboarding

How Document AI improves the customer onboarding experience

What industries are automating customer onboarding?

Success stories across industries

In today’s fast-paced world, traditional customer onboarding can feel like too much work, for both the customer and the business. Consider the following:

In that environment, legacy onboarding processes are just too slow and error prone. These rules-based workflows, often designed for desktop browsers or paper workflows, rely on a lot of manual typing, even when a customer is on a tiny smartphone. Additionally:

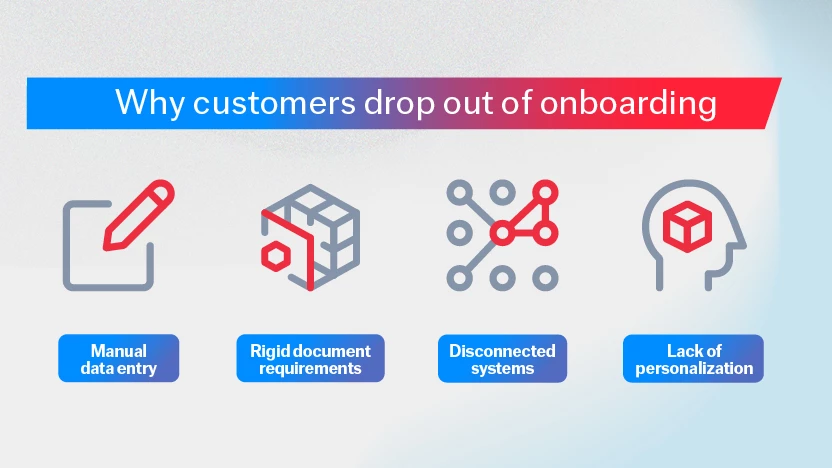

Understanding where and why customers get frustrated during onboarding is the first step toward fixing the process. Most drop-offs come down to a few pain points:

To keep customers engaged, businesses need automation that goes beyond the basics. That’s what Document AI does. It understands what the information in a document is, where that data belongs in the process, and what the customer needs next.

Document AI is intelligent document processing (IDP) technology that can read, understand, and extract information contained in documents. Basically, it turns unstructured data found in documents into structured, contextualized information that business systems can then use.

In customer onboarding, Document AI:

Combined with other technologies, Document AI becomes even more versatile. For example, organizations using chatbots as part of their onboarding process could integrate Document AI so customers can securely upload and process documents within the conversation. All in all, Document AI helps reduce onboarding abandonment rates and keep more customers engaged.

Banks and financial institutions must meet strict compliance standards without losing customers to slow processes. By automating onboarding, they can verify identities and capture data from supporting documents to follow Know Your Customer and anti-money laundering rules while still opening accounts in minutes.

Transportation companies need to onboard many different audiences, including customers, drivers, vendors, and partners. By using Document AI to capture and validate information automatically from bills of lading and other documents, companies can move faster on processes like driver registration and shipment approvals.

Insurance providers are adopting automation to process policy applications and claims with fewer manual checks, giving customers faster decisions and agents more time to focus on customer service instead of paperwork.

In the public sector, agencies are using Document AI to let citizens register for services and benefits. People can renew licenses or verify their identities online without filling out long forms or making a trip to a government office.

Healthcare organizations are simplifying patient onboarding by digitizing intake forms and verifying insurance details instantly. In addition, Document AI improves data accuracy across systems that used to operate in silos.

Every industry depends on customers, so every industry can benefit from smarter onboarding. Here are a few real-world examples of how organizations are using Document AI to make onboarding faster and easier:

By connecting Document AI into its mobile site, multi-energy supplier Butagaz made it possible for customers to simply snap a photo of their existing bill to have the system automatically recognize key details, return a quick price estimate, and offer a digital contract to sign.

Paragon Customer Communications used Document AI to automatically capture and categorize incoming documents from multiple channels. The company was to automate 90% of the work of processing over 35 million pages a year.

Document AI automatically extracted useful details from claims documents and correspondence for Ecclesia Group, a leading German insurance broker. The data was then routed to the right teams to trigger downstream processes.

Sidetrade, a global order-to-cash platform provider, added Document AI to its cash application solution to extract data from remittance documents. The system achieved over 90% accuracy out of the box and now performs straight-through processing.

ABBYY Document AI brings intelligence to every step of the onboarding journey. Our purpose-built AI-driven technology reads and understands documents similar to the way a person would, except much faster and without errors. In the ABBYY Marketplace, we offer pre-trained AI models for processing documents specific to onboarding, such as Identity Document, Bank Statement, and Loan Application.

The result is a smoother experience for both customers and employees. Customers can open accounts, apply for loans, or register for services entirely from their mobile devices. At the same time, organizations gain the confidence that every submission is verified and compliant. ABBYY Document AI can also connect with process intelligence tools to give teams the visibility to see where customers stall, helping them improve the process continuously.

In short, our technology delivers the balance every organization wants: less friction for customers and fewer risks for the business. Schedule a demo to see how ABBYY can transform your onboarding experience.

Ideally, you want to make the onboarding process as simple as possible for customers. For example, instead of typing in information, customers should be able to use a phone camera to scan in details. With the right Document AI solution, that scan is instantly read and the key information automatically extracted and processed so customers can move to the next step without delay.

The easiest way to prevent duplicate data is to make sure information only gets captured once, then shared everywhere it’s needed. With Document AI, customer details can be extracted from a single source, like a driver’s license or phone bill, then synced across your systems. Customers don’t have to retype the same details across multiple forms, and companies don’t have to deal with duplicate data sets.

Start by finding where your customers drop off or get stuck, and fix those friction points first. That will give you the biggest boost in retention rates. From there, keep improving your process using analytics from your Document AI solution and fine tuning the flow to make it faster and more intuitive over time.

Document AI and process intelligence are two technologies that are really changing customer onboarding today. Document AI reads and understands customer forms instantly, while process intelligence maps the entire onboarding journey, showing where customers get stuck or drop off. Together, the solutions can create an onboarding experience that feels fast and responsive to customers.