Vantage 3.0

Introducing a hybrid approach to using Document AI and GenAI

Supercharge AI automation with the power of reliable, accurate OCR

Increase straight-through document processing with data-driven insights

Integrate reliable Document AI in your automation workflows with just a few lines of code

PROCESS UNDERSTANDING

PROCESS OPTIMIZATION

Purpose-built AI for limitless automation.

Kick-start your automation with pre-trained AI extraction models.

Meet our contributors, explore assets, and more.

BY INDUSTRY

BY BUSINESS PROCESS

BY TECHNOLOGY

Build

Integrate advanced text recognition capabilities into your applications and workflows via API.

AI-ready document data for context grounded GenAI output with RAG.

Explore purpose-built AI for Intelligent Automation.

Grow

Connect with peers and experienced OCR, IDP, and AI professionals.

A distinguished title awarded to developers who demonstrate exceptional expertise in ABBYY AI.

Explore

Insights

Implementation

February 5, 2026

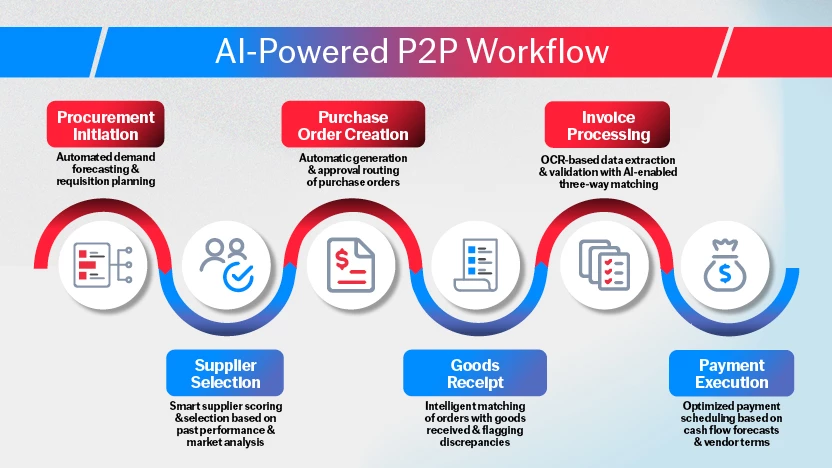

Procure-to-Pay (P2P) is shifting from back-office busywork to front-line intelligence, thanks to AI innovation.

Traditionally, the process of sourcing goods and services through paying suppliers was tedious and slow. Procurement and accounts payable (AP) teams—long seen as cost centers—performed the tasks via manual, paper-based workflows.

But advances in AI have given rise to pre-trained document extraction models that can read, reason, and learn from invoices and purchase orders (POs). In fact, many of these AI capabilities are already available out of the box through platforms like the ABBYY Marketplace. This automates P2P at scale and reveals business insights that drive better decisions, without requiring massive investments or years of development. Now, you can turn AP into a strategic driver of cash flow and profitability.

Jump to:

Why most P2P automation initiatives fall short

From OCR to AI models: A new era of document understanding

How pre-trained AI models speed P2P automation

Building an intelligent P2P workflow with Document AI

Find ready-to-use P2P AI models for your documents in the ABBYY Marketplace

For most organizations, P2P workflows are far from fully automated. A 2024 Gartner study found that only 48% of digital initiatives—including P2P implementations—are successful.

One major reason is the use of outdated automation tools that simply extract data from documents without understanding what the documents are and why the information in them matters. Without a clear sense of the content flowing through ordering, shipping, receiving, and payment, end-to-end automation can’t become reality.

Early efforts to automate P2P relied on basic optical character recognition (OCR) and robotic process automation (RPA). These technologies relied on static templates and rule-based extraction, and as a result, could only capture data from invoices and POs that came in predictable formats they’d already been trained on.

But in reality, P2P involves a wide range of document types, each with its own layout and logic. Rule-based OCR and RPA alone simply couldn’t adapt to the complexity of real business documents.

Modern AI-driven models overcome these limitations because they can understand content. They learn document structure and intent, and interpret context and relationships between documents, such as how a PO connects to a receipt or invoice, and where it fits within the larger P2P process. This contextual understanding means smarter matching and faster exception handling, which translates into higher accuracy and faster scaling across your P2P operations.

These AI models can also learn and adapt over time. Each new document helps them improve accuracy. Your P2P operation becomes easier to scale, capable of making intelligent decisions without constant human intervention.

AI innovation has sped up how quickly you can get P2P automation solutions up and running. Today, you can deploy intelligent document processing (IDP) solutions already trained to understand invoices and POs and start seeing results in days.

Instead of relying on static, rule-based templates, these solutions use containerized, low-code / no-code AI document models that can adapt to the wide variety of documents used in P2P. The models can interpret structure, intent, and relationships between documents, including how each transaction fits within the broader flow of cash and goods.

With ABBYY IDP, for example, you can access a growing set of pre-trained models and partner-built solutions tailored for P2P operations, all available through the ABBYY Marketplace. Popular models include:

These solutions are designed to plug directly into your existing enterprise resource planning (ERP) and AP systems and be up and running in minutes.

If rote automation technologies alone could fix P2P, the problem would have been solved long ago with tools like RPA and OCR. The reality is that AP operations require not just simple data extraction, but skilled interpretation and validation of its documents.

Adding this level of document understanding requires pre-trained AI models that can reason and learn like an experienced AP professional. You can apply models across every document that drives cash flow to create a real-time understanding of every payable, receivable, term, and opportunity for a P2P operation that is truly intelligent.

Real-time visibility and document intelligence are what drive P2P automation. The ABBYY Marketplace provides access to both through a comprehensive hub that includes:

Organizations across industries are using these AI models to give business users and citizen developers low-code / no-code access to advanced document and content processing—quickly and without the need for new infrastructure.

With more than 30 years of experience in enterprise document processing, ABBYY Document AI models help accounting and finance teams gain the visibility and speed needed for effective P2P operations. To learn how ABBYY’s intelligent data extraction and validation can help you modernize your operations, get in touch with one of our experts for a personalized demo.

P2P automation replaces time-intensive manual work and reduces the errors that slow down financial processes. Document data is automatically captured and validated, so organizations get work completed faster and have more up-to-date visibility into spend and liabilities to make better business decisions.

One big obstacle to true P2P automation is employing only rule-based tools—like technology that can pull a number if it’s in the same spot on every form. These types of systems are limiting because business documents today come in a wide variety of formats. A better method is to use intelligent technologies—such as pre-trained AI document models—that actually understand what they’re reading and can find the right information no matter where it appears.

Yes. Modern AI document models are designed to integrate directly with existing business systems. ABBYY’s pre-trained models, for example, act as an intelligence layer that reads, interprets, and validates documents before passing structured data into your current P2P system.