Vantage 3.0

Introducing a hybrid approach to using Document AI and GenAI

Supercharge AI automation with the power of reliable, accurate OCR

Increase straight-through document processing with data-driven insights

Integrate reliable Document AI in your automation workflows with just a few lines of code

PROCESS UNDERSTANDING

PROCESS OPTIMIZATION

Purpose-built AI for limitless automation.

Kick-start your automation with pre-trained AI extraction models.

Meet our contributors, explore assets, and more.

BY INDUSTRY

BY BUSINESS PROCESS

BY TECHNOLOGY

Build

Integrate advanced text recognition capabilities into your applications and workflows via API.

AI-ready document data for context grounded GenAI output with RAG.

Explore purpose-built AI for Intelligent Automation.

Grow

Connect with peers and experienced OCR, IDP, and AI professionals.

A distinguished title awarded to developers who demonstrate exceptional expertise in ABBYY AI.

Explore

Insights

Implementation

August 21, 2025

Submitting expenses manually is a task many employees dread. After a business trip, an employee may have to dig through emails to find digital receipts, take pictures of paper ones from their mobile device, and upload everything into a spreadsheet or expense portal—then label, date, and categorize each item. Should the employee mistype a number, a frustrating back-and-forth with finance often ensues, delaying reimbursements.

Expense management automation offers a smarter, faster option. The employee simply scans and submits their receipts and lets technology do the work of extracting relevant fields, verifying data, and routing it for processing in AP, so expenses are processed more quickly and accurately and reimbursements made faster.

With business process automation solutions becoming more strategic and intelligent than ever today, automating expense management with AI-driven solutions delivers a quick win in efficiency, and employee satisfaction, for AP departments.

Of course, to be truly effective, your automation platform needs to be purpose-built for your real-world business needs—capable of handling a variety of document types, adapting to different languages and formats, and continuously improving. In this post, we’ll explore what expense management automation is, what benefits this solution offers, and what to look for when investing in a solution.

Jump to:

Understanding expense management automation

Manual versus automated expense management

How expense management automation lowers costs

What AI brings to expense management

Expense management automation uses technology to capture, process, and track expense receipts from employees and vendors. Instead of relying on manual sorting and data entry, expense management automation uses intelligent document processing (IDP) technology to quickly and automatically extract key information from receipts and related documents.

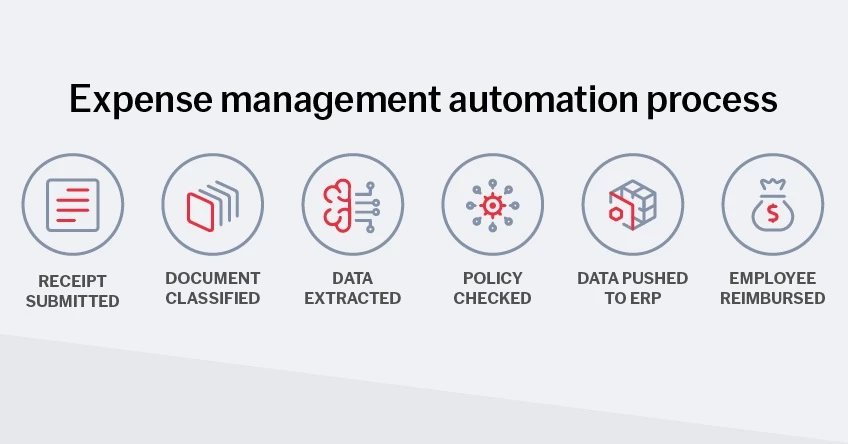

Every area of expense management can be automated, starting with how receipts—such as hotel invoices or taxi receipts—are received and processed. Whether submitted as scanned images, PDFs, or mobile photos, these documents are automatically classified by type so that the appropriate business rules can be applied. Expense management automation extracts important details like vendor names, dates, amounts, taxes, and line items—then checks for compliance with company policies. If any information is missing or uncertain, a human-in-the-loop review can be triggered. Over time, the system learns from these interactions, increasing automation rates and reducing the need for manual intervention.

Thanks to its speed and accuracy, expense management automation enables faster reimbursement cycles and better policy compliance, especially when integrated with enterprise resource planning (ERP) systems and accounting platforms. Businesses also get improved visibility into company spending to make smarter financial decisions.

Although a number of accounts payable (AP) automation solutions are available, many financial teams still do the bulk of expense management work without automation. The many manual steps involved create busywork and introduce errors, leading to employee frustration.

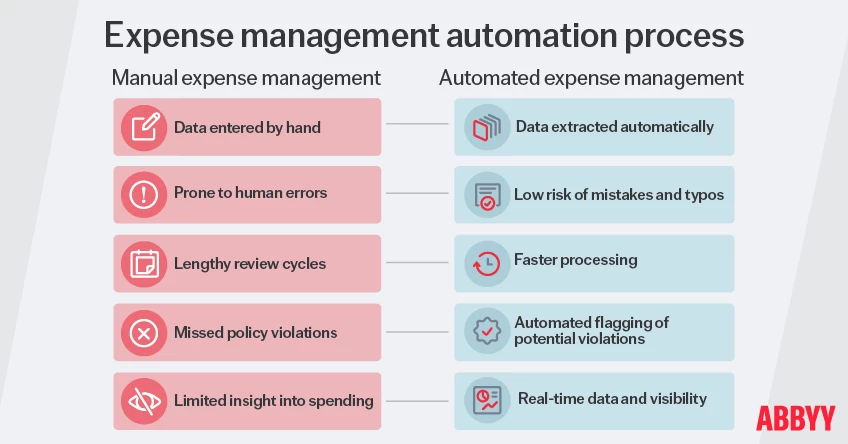

But automation can change that process entirely. Here's a quick look at how manual expense management compares to automated expense management.

Manual expense management relies heavily on employees and finance teams to collect, organize, and process expense data by hand. Typically, employees compile a mix of paper, email, and other digital receipts, which are then entered into spreadsheets or accounting systems manually. Human errors often require rework, and business visibility into overall spending is limited.

When expense management is automated, AI-driven technology captures, classifies, and validates expense data from receipts and invoices in real time. Key details are automatically extracted from receipts and checked against company policies. Documents are sorted and routed appropriately, and the data flows directly into ERP and accounting systems with minimal human intervention.

As companies grow and scale, the way they manage expenses needs to evolve with them. Here’s how expense management automation offers businesses a smarter foundation for tracking, approving, and controlling expenses.

Humans often make mistakes when handling repetitive tasks. With manual data entry, costly typos and missed fields are common. Automation dramatically reduces that error rate by extracting important data accurately and double-checking them against business rules.

Automation cuts down the time it takes to collect, process, and approve expenses, so finance teams can handle high volumes of receipts with less effort. Employees are then able to focus more of their time and energy on more strategic work, and businesses can scale without increasing headcount.

Because automation embeds policy checks and business rules directly into the workflow, the risk of policy violations and audit issues is greatly reduced. Some automation solutions also support validation against vendor databases and tax calculations to help maintain regulatory and internal compliance at scale.

With automation, employee receipts can be captured on the go, submitted in any format, and processed quickly with fewer back-and-forths and faster reimbursement.

Expense management needs can change quickly due to new vendors or compliance rules. The best expense management automation solutions can process a wide variety of document types, support multiple languages, and continuously learn from user input to improve over time.

When expense data is automatically integrated into ERP and accounting systems, businesses gain real-time insight into spending patterns and more accurate forecasting for smarter budgeting.

AI plays a central role in automating every stage of the expense management process, from receipt capture to reimbursement:

The right expense management automation solution combines out-of-the-box functionality with the flexibility to adapt to your business needs. Key features to look for include:

For businesses seeking an all-in-one solution that will grow with them into the future, ABBYY Document AI offers both out-of-the-box functionality and the AI-powered flexibility to evolve and scale. ABBYY’s intelligent document processing (IDP) platform lets you:

All of this happens with minimal manual effort. Employees simply submit scanned or photographed receipts. From there, ABBYY IDP, customized to your organization’s workflows, takes over, preprocessing photos and scans for maximum quality, detecting receipt fields, verifying totals, checking vendor databases, and calculating taxes. As the system processes more receipts, it gets smarter, learning to recognize vendors and automatically assign expense categories with increasing accuracy.

Watch this four-minute walkthrough of how ABBYY’s expense management automation works to see just how quickly you can get started. For a more tailored look at how ABBYY can automate expense management for your company, get in touch with one of our experts.