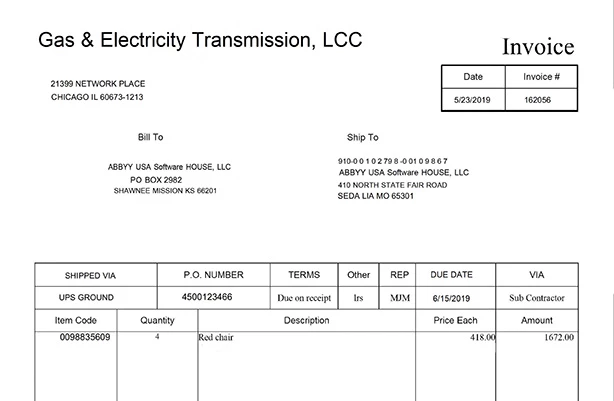

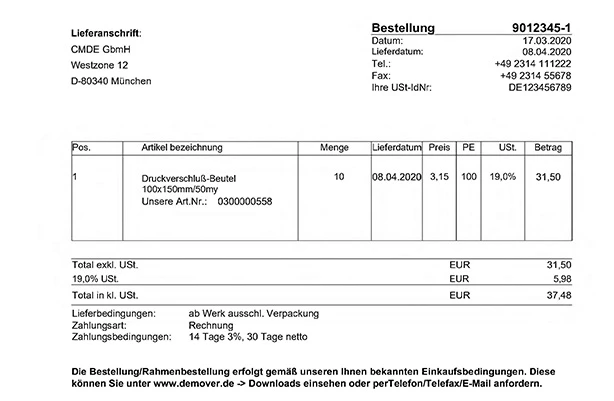

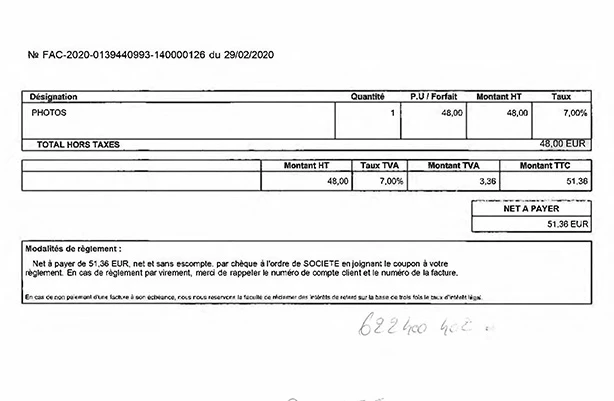

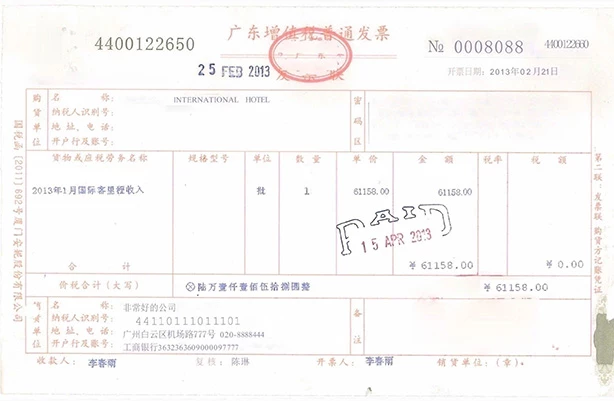

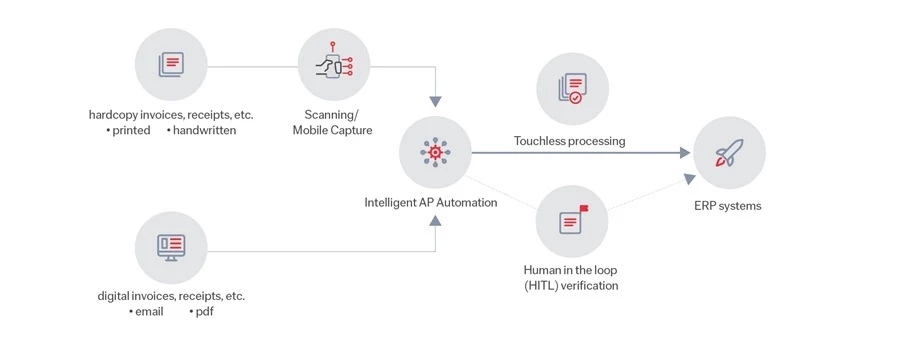

Accounts payable (AP) automation uses technology to streamline the entire process of handling invoices. Instead of manually entering data, chasing approvals, and matching information with POs—processes that are prone to errors and delays—AP automation uses software to do all this work automatically with minimal human intervention. No matter the source, format, or language, invoices are processed faster, with fewer errors, and at a lower cost.

With AP automation, you also get immediate control over and insights into your cash flow, ensuring that you stay compliant and avoid losses. It easily adapts to changes in your supply chain, quickly learning about new vendors and invoice formats as they emerge.